Todd Jablonski, CFA

Chief Investment Officer &

Global Head of Multi-Asset and Quantitative Investments

The global economy is changing gear as it adjusts to a slower rate of growth, but that doesn’t mean investors should be pessimistic. While a hard landing can’t be ruled out, the prospects for a soft landing appear far more probable. The Federal Reserve kicked off the shift towards a new global easing landscape in September 2024 with its 50-basis-points cut in interest rates, followed by a 25bp cut in November. Further monetary policy easing is anticipated 2025. With many other global central banks following suit, risk assets such as equities are expected to benefit.

The shift toward easing monetary policy reflects that inflationary pressures have eased, and the Fed is now shifting its focus to the health of the labor market. While investors would love to say that inflation has subsided appropriately, we believe it is too early to claim that a return to a stable 2% inflation rate is assured. A deviation from current disinflation trends could pose challenges to the Fed’s ability to ease further. In this evolving market context, diversification will prove essential in allowing investors to navigate the complexities ahead.

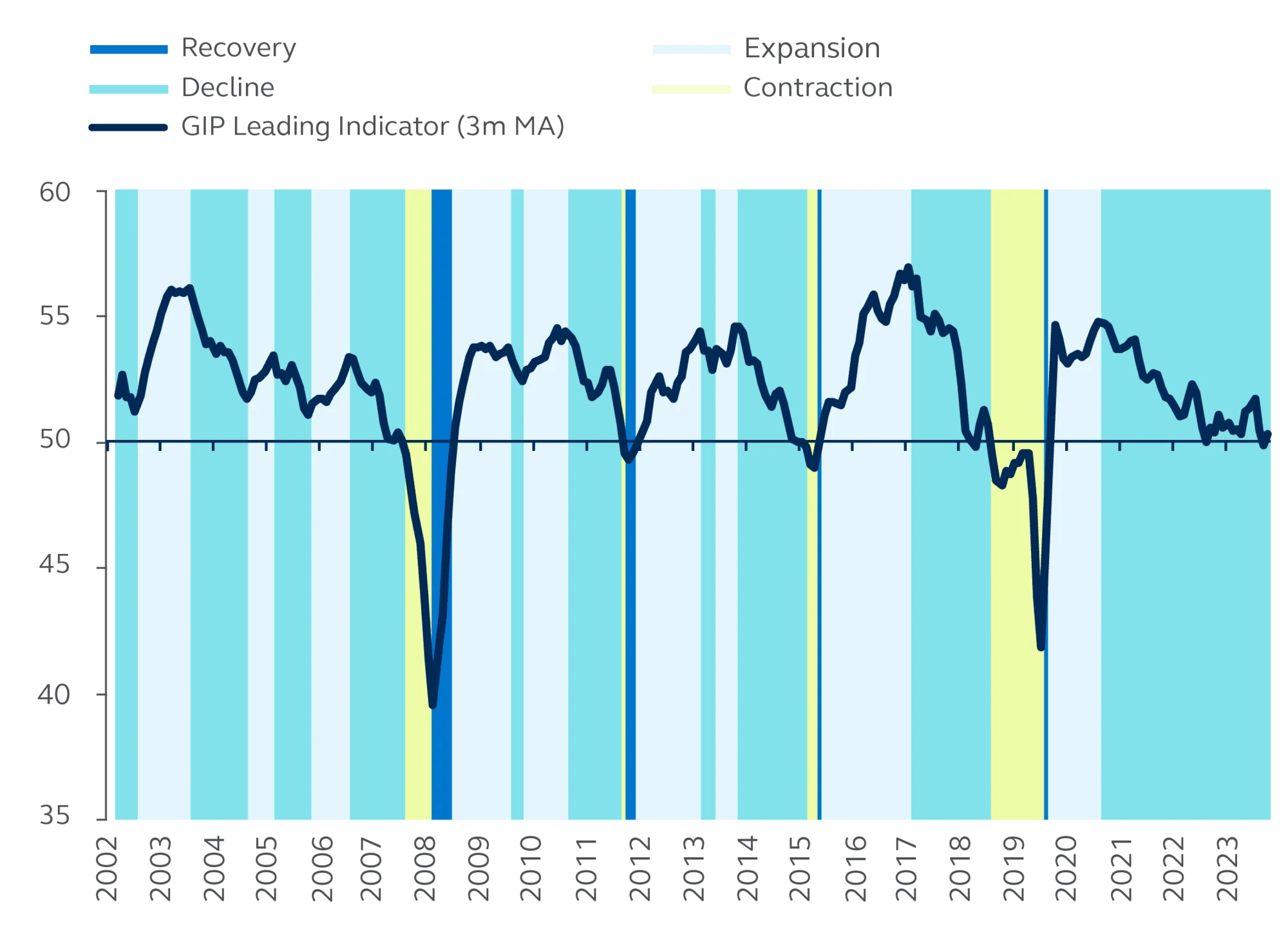

We believe the market cycle is composed of four distinct stages: recovery, expansion, contraction, and decline. Currently, the global economy is experiencing a prolonged, three-year period of economic decline. Such declines have historically led to one of two potential resultant outcomes: expansion or contraction, and it’s the latter that often results in negative returns for risk assets. Will the current decline result in a painful contraction and negative returns for stocks, or are we headed for a soft landing with a swift rebound to follow? Looking through the short-term noise, we believe a soft landing and modest expansion support the case for a slight equity overweight.

Figure 1: Principal Asset Allocation regime indicator

Z-score, 2002–present

Source: Bloomberg, Principal Asset Allocation. Data as of September 30, 2024.

In the words of Harry Markowitz, the Nobel prize-winning economist best known for his pioneering work in modern portfolio theory, “the only free lunch in investing is diversification.” Adopting a multi-asset investment strategy allows investors to diversify across uncorrelated asset classes, and position portfolios to weather potential market storms while remaining poised to seize opportunities as risk appetite returns. This approach transcends the simplistic binary approach of preparing for either contraction or expansion, better equipping investors to increase the probability that they can reach their goals despite an ever complex and evolving macro-economic outlook.

The Fed’s easing cycle should support equities, presenting opportunities in the U.S. across all market capitalization categories. While large cap U.S. equities have generated the lion’s share of market returns of late, we have shifted to a more neutral stance on U.S. equities in anticipation of the global growth outlook starting to slow. US mid- and small-caps could be better positioned going forward than they were in the era of low rates and low tariffs.

Outside the US, most regional valuations are high and global markets have collectively performed well. The most attractive valuations to date are in Latin America and Hong Kong. Japan also stands out, where equities are benefiting from shareholder returns through dividends and/or share buybacks. Europe, conversely, continues to search for an economic acceleration and we remain underweight developed European equities.

A diversified basket of emerging-market equities aims to provide portfolio diversification across regions which may ultimately translate to improved risk-adjusted returns. We are neutral across the emerging market equity complex, but we do see opportunity in select countries. Notably, Indian and Taiwanese equity markets have attractive growth characteristics. China’s policy pivot has led to a quick market recovery, yet we need to see material fiscal stimulus action before our outlook changes on the region.

Historically, bonds have typically brought stability to a portfolio. Bonds typically have a lower standard deviation than equities. Of late however, bond volatility has indeed been below that of equities… but bond volatility has been higher than what’s typical for a stability asset class. What is causing the current bond volatility? It’s interest rate volatility. Rate volatility has picked up as investors are striving to anticipate the speed and degree to which central banks will ease monetary policy. Any separation between investor expectation and central bank action results in excess volatility.

Historically, bonds have typically brought stability to a portfolio. Bonds typically have a lower standard deviation than equities. Of late however, bond volatility has indeed been below that of equities… but bond volatility has been higher than what’s typical for a stability asset class. What is causing the current bond volatility? It’s interest rate volatility. Rate volatility has picked up as investors are striving to anticipate the speed and degree to which central banks will ease monetary policy. Any separation between investor expectation and central bank action results in excess volatility.

We anticipate as the easing cycle ensues that the yield curve should start to steepen as the long end of the curve is expected to drift higher. However, as the easing cycle becomes established, yield curves are expected to be more stable and provide an opportunity as a hedge for growth risks.

On the short end of the yield curve, we favor high-quality credit and carry, and we have been underweight to the lower quality credit part of the curve.

At the same time, we also find opportunities on the long end of the curve to help manage growth risks. A position in 30-year US Treasuries allows us to keep a defensive strategy at the ready. They offer attractive yields and should provide a safe haven should markets experience any unexpected shocks, such as geopolitical developments. Economic news may also trigger volatility, although we expect this to stem from growth rather than inflation shocks.

We are generally underweight commodities; however, we do see opportunity in gold. Gold price action is a function of supply and demand, and rising demand should lead to higher prices; thus, we are optimistic on gold in a multi-asset portfolio. China and India, which account for 35% of the world’s population, are generating a steadily increasing demand for gold.1 India has also reduced its gold import duties from 15% to 6%, a move that should continue to fuel demand.2 Moreover, central banks are buying for diversification purposes, including a move away from the dollar.

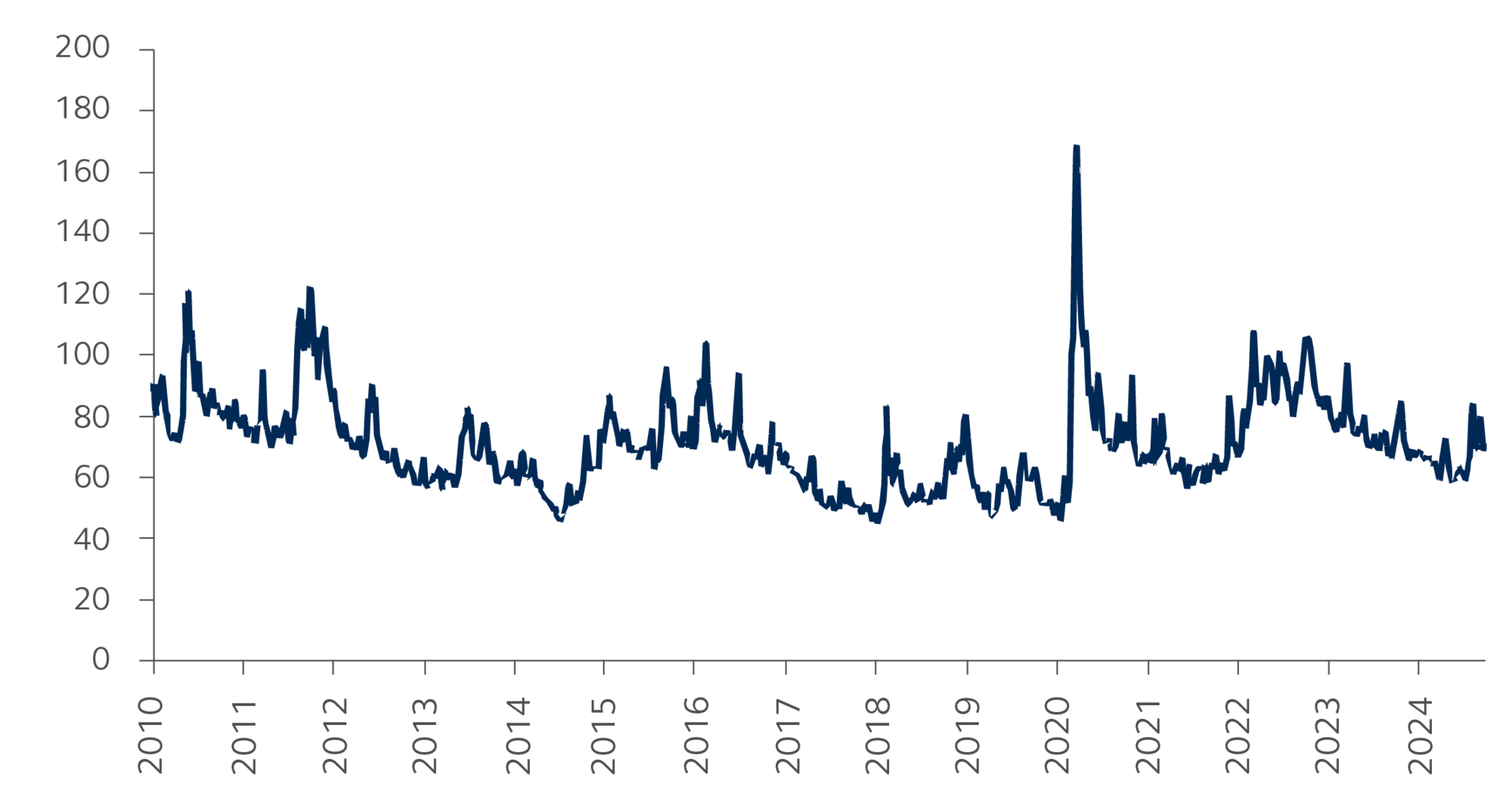

In a world subject to a multitude of geopolitical and economic risks, a multi-asset approach clearly should have a strong appeal to investors. It offers the largest opportunity set of investment choices. Moreover, by exploiting the varying returns from different asset classes and sectors, investors can offset risk and achieve smoother returns in a way that is not possible when investing in either single markets or single asset classes. Given that volatility could be spiking again, as shown in Figure 2, that is clearly an important consideration in today’s environment.

Figure 2: Volatility on an upward trend

PAA Cross-Asset Volatility Index

Weighted market implied volatilities of equities, bonds, currency and crude oil

Source: Bloomberg, Principal Asset Allocation. Data as of September 30, 2024.

In conclusion, mixing different asset classes with lower standard deviations and potentially inverse correlations creates the ability to generate risk-adjusted returns. Diversification thereby offers the potential to smooth portfolio returns and provide better protection during drawdown periods.

- As of 30 November 2024. Source: Worldometer

- As of 30 November 2024. Source: World Gold Council

For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in Permitted Jurisdictions as defined by local laws and regulations.

Risk considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Equity investments involve greater risk, including heightened volatility, than fixed income investments. Small- and mid-cap stocks may have additional risks including greater price volatility. Fixed‐ income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Asset allocation and diversification or a downside risk reduction/protection strategy do not ensure a profit or protect against a loss.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Malaysia by Principal Asset Management Berhad which is regulated by the Securities Commission Malaysia. The Securities Commission Malaysia does not review advertisements produced by Principal.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Asset ManagementSM is a trade name of Principal Global Investors LLC.

© 2024 Principal Financial Services, Inc., Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.