Spectrum Asset Management

U.S. Treasury yields are expected to remain elevated, creating a favorable environment for income growth for hybrid securities. Investors in preferred and capital securities with high allocations to fixed-to-refixed capital securities can benefit in these conditions.

For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in Permitted Jurisdictions as defined by local laws and regulations.

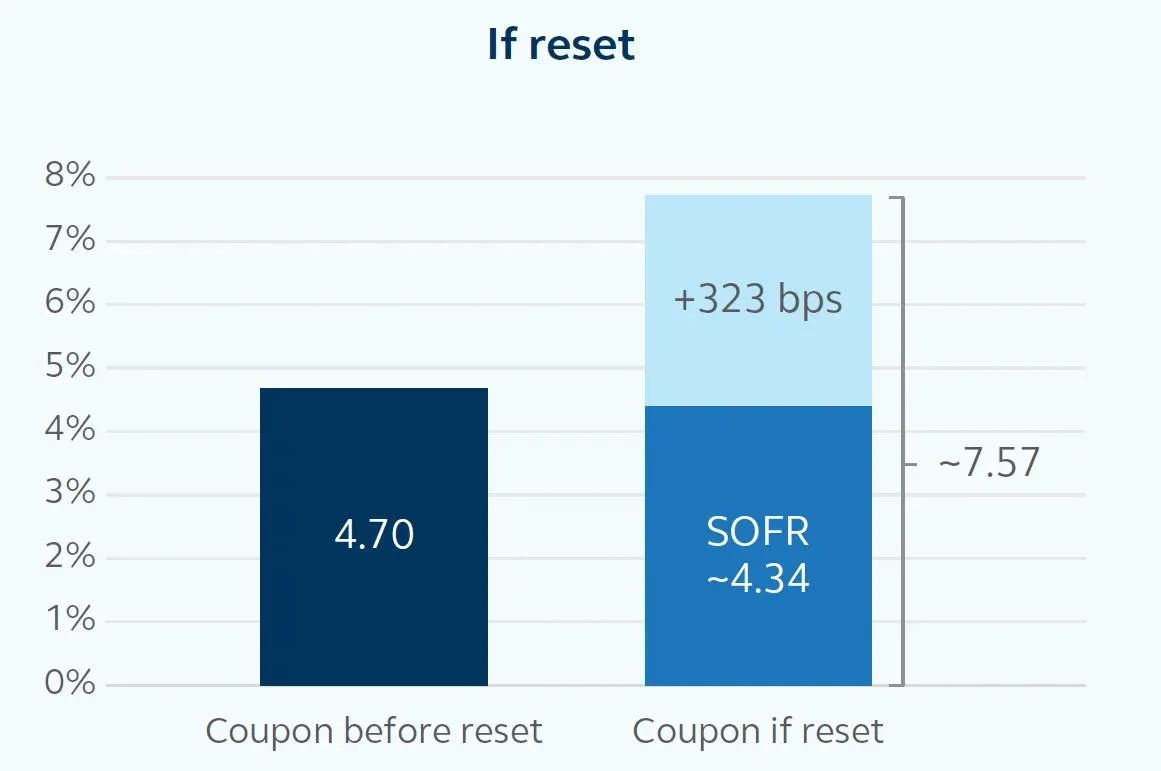

Issuers of fixed-to-refixed securities typically face two options: allowing a security to reset at a higher rate or calling the security at par. Investors may be concerned about the outcome of either option, with some finding it counterintuitive that an issuer might call a security with a low coupon when interest rates are higher. However, in the current market rate environment, both options can offer income advantages for investors, as shown in the example below.

Citigroup’s fixed-to-refixed perpetual preferred stock, trading at a discount at $95 in early 2024, was redeemed in 2025 at par ($100). Prior to the Citigroup redemption announcement, it was expected that the dividend reset structure of +323 basis points (bps) would reset the coupon higher, boosting income due to the reset.

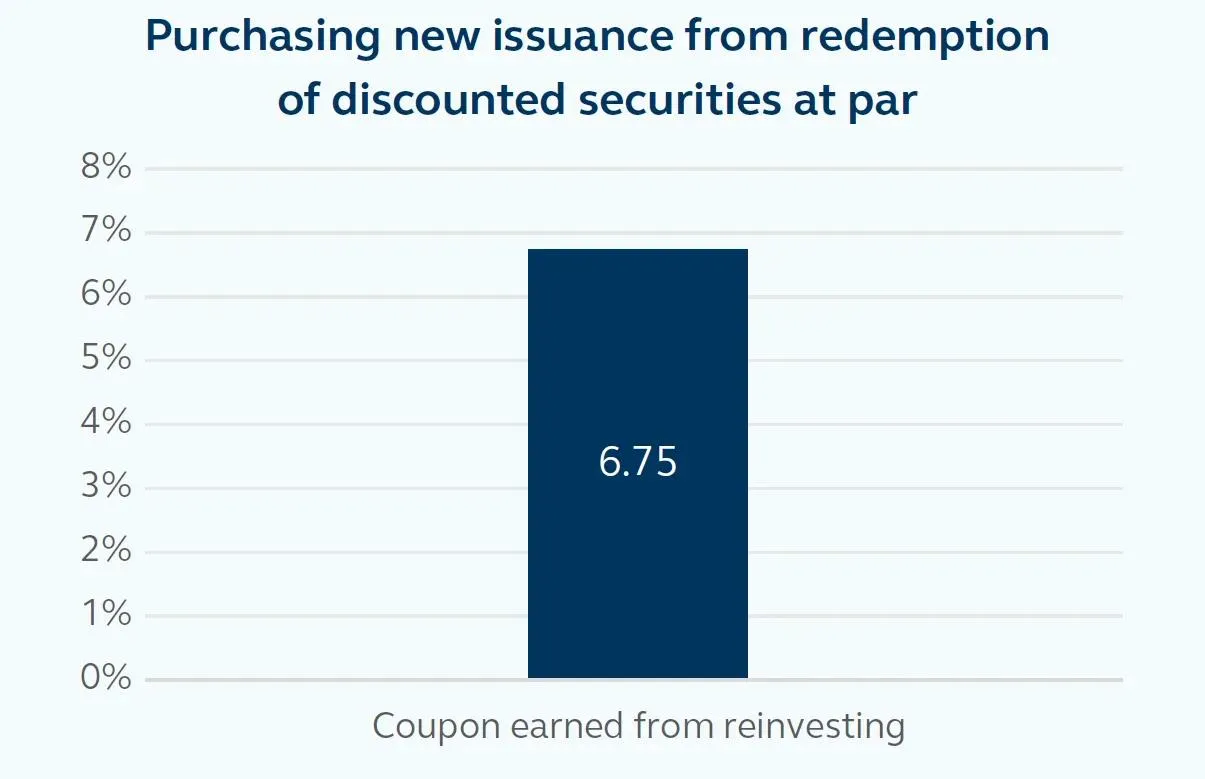

However, with the redemption, investors received a payout from their discounted securities at par and had the opportunity to reinvest the proceeds into a new security offering a higher yield. Further, if they purchased securities with similar reset coupon structures, they would also be rewarded with the refixed income push-up, potentially securing attractive income that can last at least another five years due to its reset off the five-year Treasury.

Source: Spectrum Asset Management, Bloomberg. As of January 27, 2025. The case study is for example and illustrative purposes only and not an indication of future results and no representation as to the returns that may be experienced by investors.

Companies are faced with an economic decision—is it more cost effective to let the coupon reset higher and pay out the higher yield to the bondholder, or is it better to redeem a security at par and issue a new security at the market rate? Both options can bode well for preferred and capital securities investors looking for income growth.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain `forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intent for use in

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/ Jurisdictions. This material is issued for Institutional Investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Spectrum Asset Management, Inc. is an affiliate of Principal Global Investors.

MM14343 | 02/2025 | 4247240-102026-4301045