Your organization's retirement plan can be a powerful tool for helping you live the life you want in retirement.

5:04

Benefits of saving in a retirement account

Acceda al video en español para conocer por qué ahorrar para la jubilación ahora es tan importante y los tres sencillos pasos para inscribirse:

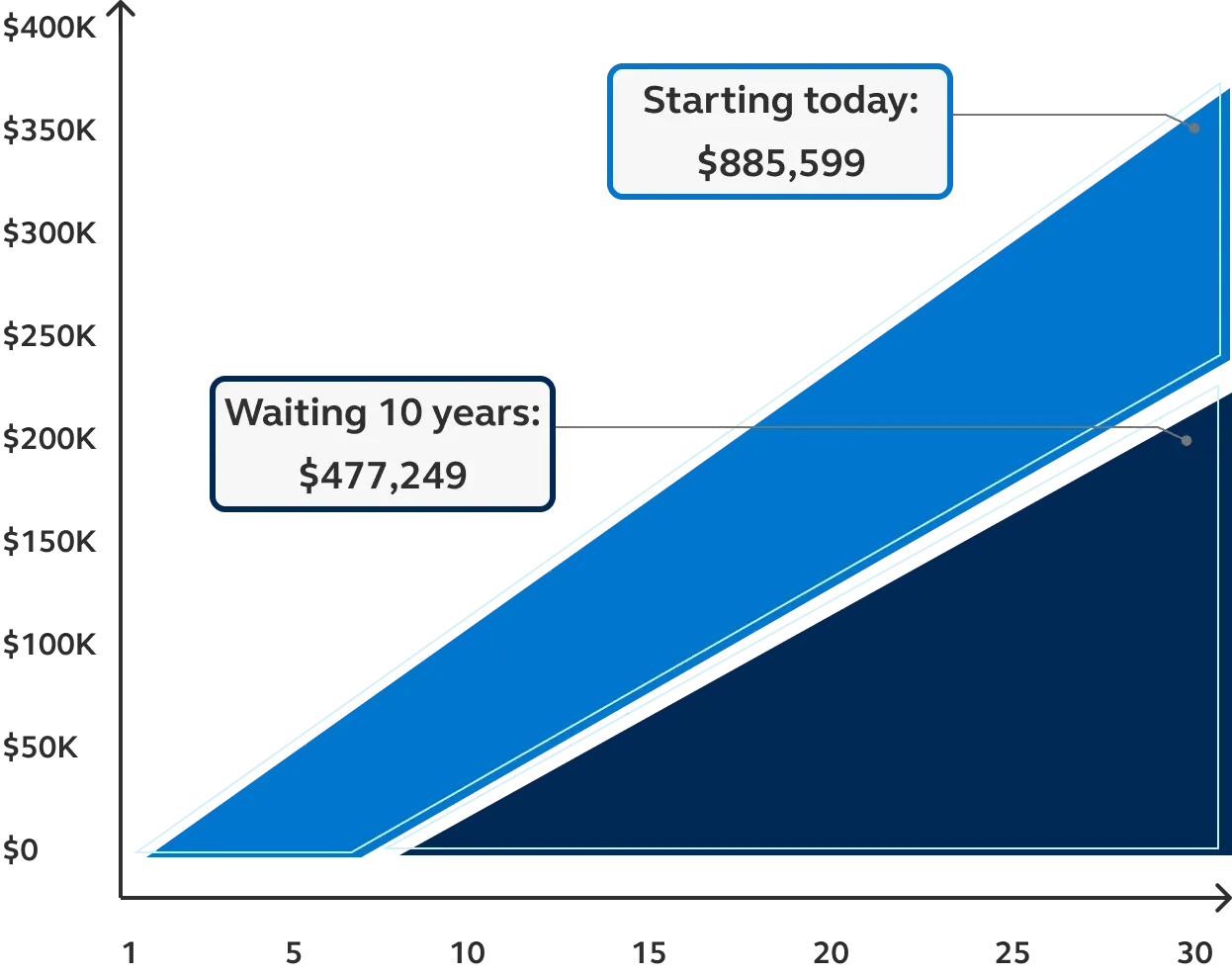

If someone starts today and saves for 30 years, they will contribute about $100,000 more from paychecks than someone who waits 10 years. But they could have more than $400,000 more at retirement—thanks to compound earnings.

- Social security may only cover 40% of your retirement needs.

- Your savings may have more time to grow.

- You can potentially lower your tax bill today with pretax savings.

This chart assumes a starting salary of $60,000, 6% starting contribution rate, 3% annual salary raise, a 1% annual contribution increase until 15% is attained, and a 6% annual rate of return on investment, compounded biweekly. This example Is for illustrative purposes only. The assumed rate of return is hypothetical and does not guarantee any future returns nor represent the return of any particular investment option. Amounts shown do not reflect the impact of taxes on pretax distributions. Individual taxpayer circumstances may vary.

Getting started is easy and only takes a few minutes.

Create your account

Set up a username and password, or log in if you already have an account with us.

Decide how much to save

Some people start with 6%. You can save more or change the amount anytime.

Review your investment options

You can review and pick your investment options, or go with your organization's default choice.

- Social Security may only cover 40% of what you might need in retirement, so it helps to have another source of income.

- You can potentially save on taxes now—putting in money before taxes lowers your tax bill today.

- The sooner you start, the longer your savings have to potentially grow. Even small amounts can make a difference for your future.

The answer depends a lot on you. Your age. How much money you make. And what visions you have for retirement. Principal research suggests that saving 15% of your pay can help you have enough for retirement.

That's okay! Even a small amount can grow over time. The earlier you start, the greater your potential growth as earnings generate their own earnings. (This is called compounding.)

Nope! You can choose your own investments, select a pre-built option, or go with your employer’s default option for a quick way to get started.

Register your account anytime, anywhere.

Select your app store to download and register your account today:

The Principal® app is rated 4.8 stars on the iOS App Store and 4.7 stars on the Google Play Store.

The Principal® app is also available in