Resources for You

As you evaluate your employee benefits now and for the future, reviewing these points can help smooth out the process—so you can build a benefits package you and your employees feel confident in.

Have you reviewed your existing coverage?

Benefit needs for your organization may change over time. Log in to review current employee benefits.

Are your benefits staying competitive among your peers?

Benchmark your employee benefits to see how they compare to other organizations of your size, industry, and region.

Are your employees taking advantage of free or discounted services?

Help employees live their best lives by promoting discounts and services available through Principal® group benefits.

- Emotional health support line.

- Employee assistance program (EAP).

- Legal documents and travel assistance. Employees with group life insurance have access to create simple legal documents online, and also have access to travel assistance.

- Beneficiary support. Beneficiaries of group life policies receive access to comprehensive support services after a loved one dies.

- Discounted services. Employees and their dependents receive discounts on laser vision correction and hearing aids. These discounts are not insurance.

Have you made staffing changes?

Review your employee base. New hires, retirements, and shifts in the average age of your workforce may call for some benefit adjustments. And shifting full-time employees to part-time may mean they're no longer eligible for benefits. Use this resource if an employee has left your organization.

Do employees still have children that qualify for coverage?

Review if employees with child coverage still have dependents who qualify for coverage as defined in contract provisions. If not, dependents should be removed.

Who pays the insurance premium?

You can offer a combination of employer-paid and employee-paid (voluntary) coverage. If budget is tight, employees could pick up the entire cost of the premium with voluntary group benefits.

Is employee salary information up to date?

Renewal is a good time to update employees’ salaries. This will ensure records are accurate if an employee makes a claim.

Anticipating a merger or acquisition?

Even if the change is well into the future, you may want to plan now to potentially adjust your benefits.

Did you know employees can easily increase life insurance every year?

When you offer Principal voluntary term life insurance, employees can increase their coverage every year during enrollment—without having to answer health questions or make a medical appointment.

Do you have the ease of managing your group insurance in one place? Principal offers these group benefits—and our multi-product discount may save you and your employees money.

Disability insurance

Short-term and long-term disability insurance replace a portion of an employee’s income if they’re too sick or hurt to work.

Dental insurance

It’s simple to customize dental insurance based on your and your employees’ needs. Plus, our large network means employees have a variety of dentists to choose from.

Critical illness insurance

Employees diagnosed with a specific critical illness receive a lump-sum cash benefit to help alleviate financial worries during a serious illness.

Hospital indemnity

Hospital indemnity insurance helps pay expenses related to hospitalization and treatment due to a sickness or injury.

Life insurance

Life insurance helps employees protect their loved ones in the event of their death. And you can choose to pay for all, part, or none of the premium.

Vision insurance

Vision insurance covers services like exams, prescription glasses, and contacts. Employees have access to an established network of providers.

Accident insurance

Accident insurance provides a lump-sum cash benefit directly to an employee after having a covered injury—regardless of other coverages or expenses.

Paid family and medical leave (PFML)

Offered in select states

Value of offering employee benefits

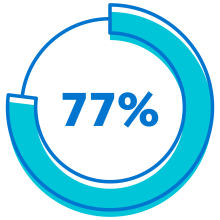

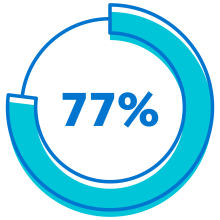

77% of business owners say the employee benefits package helps improve their ability to recruit qualified employees.

77% of owners say employee benefits improve retention.

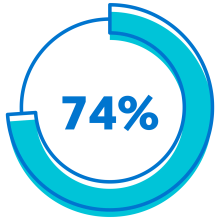

74% of owners say employee benefits improve productivity. This percent has grown from 42% in 2015.

It's easy to manage your benefits online—review benefits, update employee information, and view/pay your bill.

For assistance contact your Principal representative or group benefits broker.

We can connect you with a financial professional.

Find a financial professional