A recent Principal® study of 1,000 working Americans with access to retirement savings plans reveals that life's financial ups and downs frequently interrupt retirement savings.

The path to retirement isn't always a straight line, according to new research from Principal Financial Group®. A recently released study of 1,000 working Americans with access to retirement savings plans

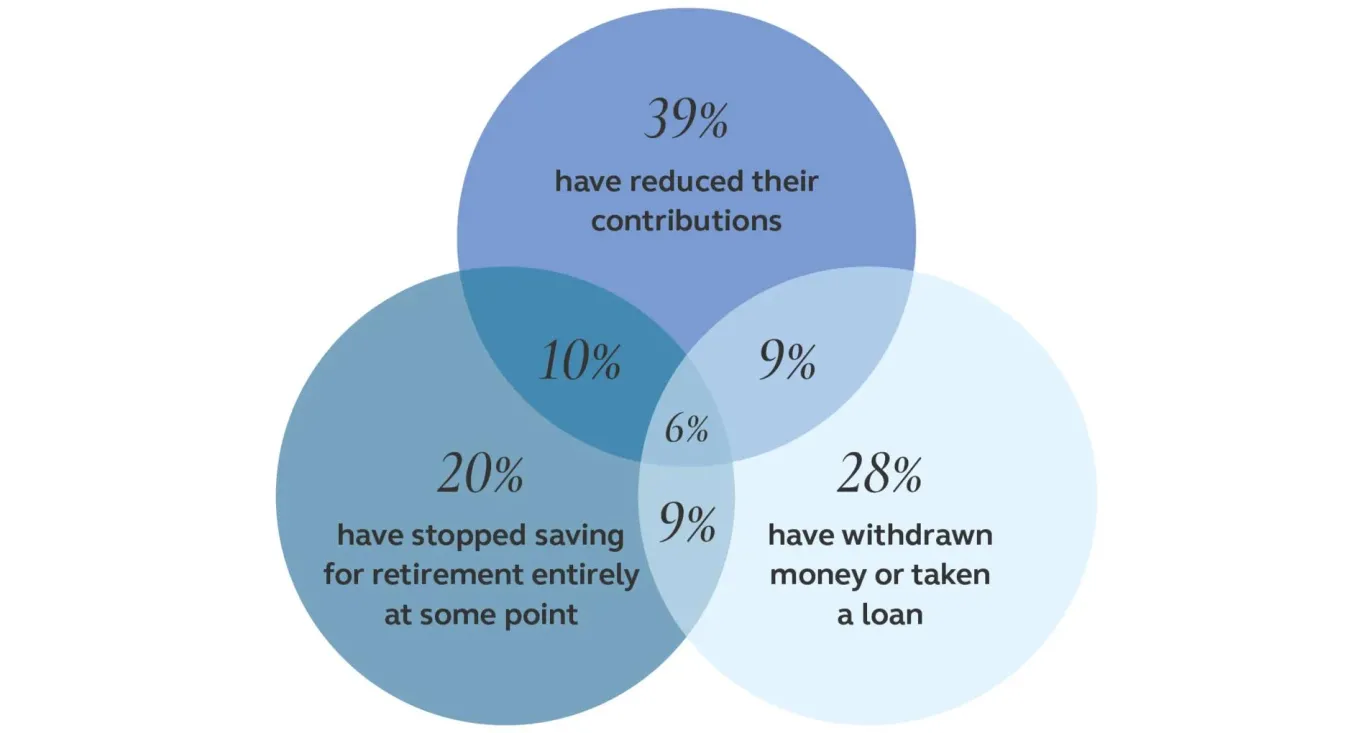

Percent of retirement savers who've at some point shifted their savings behaviors in one or more ways

Even with these shifts, there's encouraging news: 78% of those who completely stopped saving for retirement were eventually able to restart their contributions. The research paints a realistic picture of retirement planning in America, where financial resilience often matters more than perfect consistency.

The main reasons for reducing retirement investment contributions were high monthly expenses, low income, unexpected life events, and debt repayment. For withdrawals, the top reasons included essential expenses, house down payments, and to cover a household job loss.

Recovery chances varied based on the reason for stopping; those who stopped due to unexpected life events or debt repayment had better recovery rates than those who stopped due to high monthly expenses or low income.

The study also identified characteristics of top retirement savers (those saving 15%+ of their income for retirement):

- More diversified retirement accounts (average of 2.8 retirement account methods vs. 2.2 for those saving at lower rates)

- Higher use of Individual Retirement Accounts (65% vs. 39% for those saving at lower rates)

- Lower likelihood of reducing, stopping, or withdrawing retirement contributions (42% vs. 64% for those saving at lower rates)

Impacts of relationships on retirement savings are also highlighted. Partnered individuals showed several advantages:

- Higher confidence in maintaining living standards into retirement

- Earlier expected retirement age (62.8 vs. 64.3 for singles)

- 84% have partners also actively saving for retirement

Regarding divorce impacts, 6% of those who withdrew from retirement accounts did so due to divorce settlements. These withdrawals showed better recovery rates (53%) compared to withdrawals for other reasons such as debt repayment (43%).

Overall, the research emphasizes that while retirement saving challenges and interruptions are common, recovery is possible. Check out the full report for more details and insights.