Many Americans aren’t saving enough for retirement. But new legislation aims to help. Explore six highlights for small businesses that can help them help their employees foster financial security.

Americans are due for a retirement confidence boost.

Consider:

- Three in 10 workers don’t have access to a retirement plan through work.

- Of those who do, nearly half don’t participate.

The widening gap between how much money people need to retire comfortably and how much they’ve saved was identified as a key disruptor in the 2022 Principal® Future of Retirement survey.

Retirement legislation is here to help. Among its many perks and provisions, the SECURE 2.0 Act of 2022 helps knock down barriers to entry for retirement plan sponsors (businesses) and participants (employees), setting up both for better financial security.

According to the 2023 Principal Financial Well-Being IndexSM:

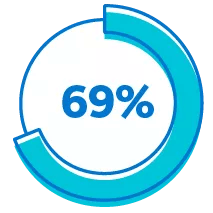

of employees believe saving for retirement is important for their financial security.

of businesses say it’s their responsibility to help employees save for retirement.

Highlights of SECURE 2.0

The groundbreaking legislation boosts access, promotes participation, and aims to alleviate the all-too-common predicament of saving too little too late. Here are six key features for small businesses to know:

Tax credits can offset retirement plan start-up costs 100% for the first three years for businesses with 50 or fewer employees, up to a maximum possible credit of $5,000 each year. Businesses with up to 100 employees get a good chunk of the credit, too.

Many employers choose to match the money employees are putting into their accounts as a valuable workplace benefit. Tax credits can now offset the expense up to $1,000 per employee in start-up plans for the first two years, with a reduced credit over the next three years.

of employees say employer match contributions help them save for retirement.

For many Americans, student loans overshadow retirement savings. Starting in 2024, businesses may choose to match qualified student loan payments, with the matching contributions deposited to the employee’s retirement savings.

of employees would be interested in setting up automatic student debt payments through their employer.

Part-time workers have historically been excluded from employee benefits. The original SECURE Act passed in 2019 made anyone who worked at least 500 hours for three consecutive years, starting in 2021, eligible to participate. SECURE 2.0 reduces this requirement to only two consecutive years and includes 403(b) plans. Effective in 2025, anyone who’s worked at least 500 hours (about a quarter of a full-time position) for two consecutive years is eligible to participate.

Starting in 2025,

of employees are comfortable with auto-enrollment.

In tandem with automatic enrollment, employees’ contribution rates will automatically increase 1% each year, up to 10–15% of their wages.

of employees are comfortable with auto-escalation.

Get full details on SECURE 2.0 provisions for small employers (PDF).

If this feels significant and game-changing, it’s because retirement security has bipartisan support. “This is coming to light as a fundamental need for American workers,” says Lance Schoening, director of policy at Principal.

“It goes to show how powerful these retirement tools and provisions are, and how proven they are in delivering positive results for workers—helping them save earlier in their careers and at progressively higher levels,” Schoening says.