Why it might be time to shift your pension investment game plan for 2025 and beyond.

Key takeaways

- The success of return-seeking strategies has improved U.S. pension funding positions to the point where less risk-taking may be needed to maintain plan stability.

- Pension plan sponsors with high allocations to return-seeking asset classes might consider de-risking strategies to help safeguard gains they may have achieved over the past four years.

- Liability driven investing (LDI) strategies historically have shown value during “flights to quality”. Now may be an opportune time to evaluate reallocation strategies for long-term stability.

A dynasty’s run: Equity-heavy portfolios extend their winning streak

In sports, a “dynasty” can describe a team that dominates year after year, defying expectations and retaining its championship status. Dynasties often command respect and leave an indelible legacy. Over the past four years, equity-heavy defined benefit (DB) pension portfolios seem to have built a similar legacy, consistently outperforming LDI strategies.

At the start of 2024, some predicted a reversal of fortunes for “traditional” equity-heavy return-seeking strategies. Political uncertainty, inflation concerns, and record federal deficits seemed poised to tip the scales in favor of risk-averse strategies like LDI. Yet, as often happens in sports, the reigning champion—equities—refused to relinquish its throne, outperforming liability hedging strategies by about 12%—a stunning victory that few predicted.

A closer look at the film: Comparing pension investment strategies and net returns

For winning teams, reviewing game footage helps reveal the moments that secure victory. Similarly, pension portfolio analysis highlights the strategies that delivered results.

Consider this comparison of a hypothetical pension plan’s returns:

- “Traditional” equity-heavy return-seeking portfolio: 60% equities and 40% core bonds.

- LDI-heavy portfolio: 20% equities and 80% long-duration bonds.

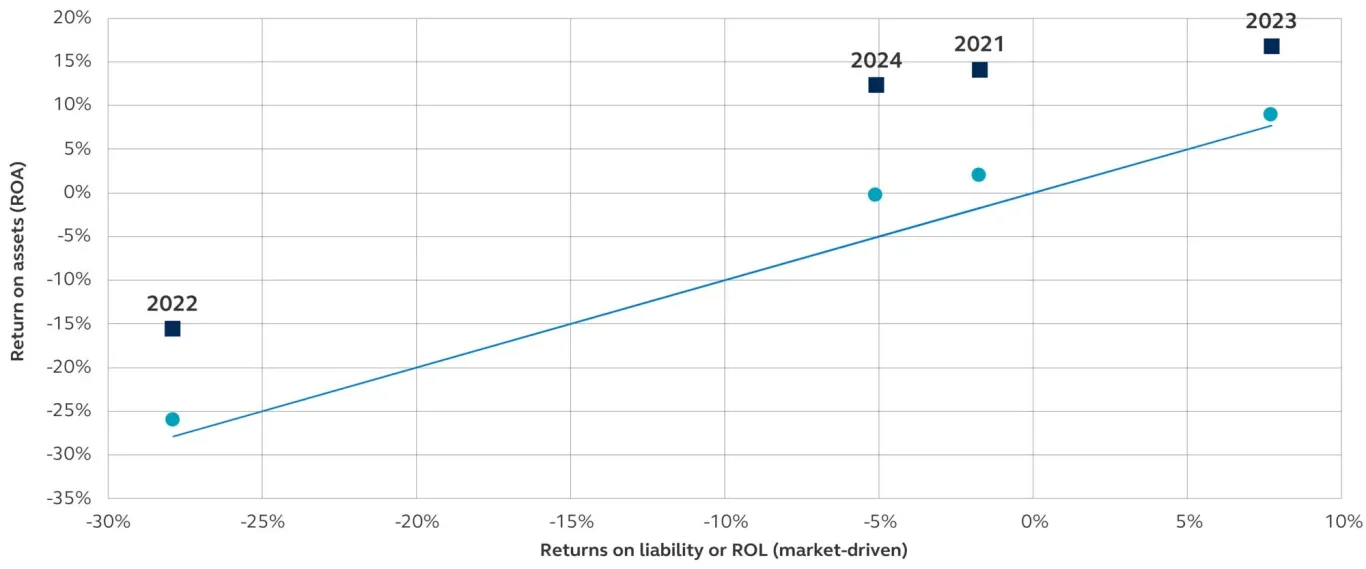

Hypothetical portfolio vs. liability returns

For illustrative purposes. The blue line marks the point where asset and liability returns are equal. Points above the line indicate positive net returns, reflecting gains over liabilities, while points below the line show negative net returns, signaling a shortfall.

What the box score reveals:

- “Traditional” portfolios posted net returns of +17.5% in 2024, compared to 5% for LDI portfolios.

- Over four years, “traditional” portfolios outperformed LDI portfolios by +55% to 12%.

The highlights:

- “Traditional” equity-heavy portfolio allocations have delivered consistent gains, avoiding significant negative net returns for a decade, even amid volatile market conditions.

- The LDI portfolio's stability-focused design keeps it aligned with liabilities, but recent years of overwhelmingly positive market volatility have favored equity-heavy strategies.

- The reliance on favorable equity performance highlights a key vulnerability: a market reversal could swiftly erode DB plan funding gains.

- Now may be the ideal time to de-risk by introducing LDI strategies to lock in gains, reduce some equity exposure to volatility, and position portfolios for long-term stability.

The end of a dynasty: Considering a defensive risk strategy with LDI

While dynasties can dominate for years, they all eventually end. There’s no way of knowing whether the trend of positive returns for equity-heavy strategies will persist throughout 2025 or beyond.

For pension plan sponsors with something to conserve, now may be the time to de-risk in preparation for the inevitable challenges ahead. Shifting economic conditions, market corrections, and evolving funding needs could disrupt the playbook of return-seeking strategies.

LDI portfolios can provide a defensive cornerstone by aligning assets with liabilities to help minimize equity risk and stabilize funding during market turbulence. LDI has proven its greatest value during “flights to quality,” when spooked equity investors seek generally safer fixed income options. This increased demand for bonds can lower yields and boost the value of LDI portfolios and pension liabilities. While equity-heavy portfolios risk abrupt losses from simultaneous stock declines and liability increases, LDI portfolios seek to safeguard funding ratios with liability-correlated returns.

A well-timed pivot to LDI can help defend the hard-won gains of recent years and position your DB plan portfolio for lasting success in the seasons ahead.

Every dynasty needs a strong coach: Work with a leader in pension services

No matter where you are in your pension journey—from accumulation to hibernation or transfer—we offer tailored solutions for each stage.