Data shows that automated features such as automatic (auto) enrollment, auto-increase, and re-enrollment can significantly improve participation rates and help employees save for retirement.

A recent survey revealed that 93% of employers say it’s their responsibility to help employees save for retirement.

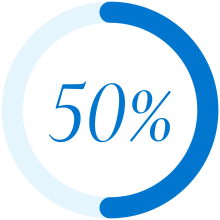

As employer-sponsored retirement plans have moved from defined benefit to defined contribution plans, employees not auto-enrolled must make the choice to start saving in the retirement plan. This has led to a significant number of employees eligible but not participating in their retirement plan.

of eligible employees are not participating in their workplace retirement plan.

Employees don’t just want the nudge auto-enrollment provides—they assume it. In a survey, 65% of employees said they expect to be auto-enrolled in a workplace retirement plan when starting a new job.

The survey also asked employees why they weren’t participating in their employer-sponsored retirement plan—59% mistakenly thought they were participating. Of those, nearly half thought they were auto-enrolled.

By embracing auto-enrollment, plan sponsors can help curb confusion and get employees on their retirement savings journey.

I’ve heard many participant stories in my tenure consulting with plan sponsors on retirement plans. The most heartbreaking is when they feel they did “all the right things” throughout their careers, yet their account balances came up extremely short at retirement. In some cases, they were auto-enrolled but never increased their contribution percentage beyond the default rate.

Plan sponsors can help change these stories by implementing auto-increase. Here, the plan is designed to increase the participant’s contribution rate by at least 1% each year until it reaches a cap set by the plan, typically around 15% when including the employer match. This would set contributions to industry-suggested contribution rates at which they are more likely to save enough to replace 70%-85% of their pre-retirement income.

Auto-enrollment and auto-increase are best practices to help increase participation and contribution rates, but some employees can still fall through the cracks.

- Employees who initially opt out of auto-enrollment and are never asked again to participate in the retirement plan.

- Those who stop contributing for one reason or another but forgot to re-enroll.

- Those contributing less than the default rate set by the employer.

By annually re-enrolling all non-participants into the plan and increasing the contribution rate for those contributing less than the default rate, plan sponsors can help employees get back on track for retirement. With re-enrollment, employees can still opt-out if they are still not ready to participate. But it allows them to make the conscious decision to delay saving for retirement for another year.

The potential cost of automated features is often the reason we hear from plan sponsors for not adopting these best practices in plan design. But cost doesn’t have to stand in the way. It’s possible to accommodate the budget while incorporating these features into the plan. Here are a couple of ways:

As we’ve shown, automated features work to help employees get into the plan and save enough for retirement. Yet nearly 80% of small businesses, those with less than 50 employees, don’t implement, citing cost as the reason.

That’s why in the SECURE Act of 2022 (SECURE 2.0), Congress included tax credits for not only starting a retirement plan, but for implementing auto-enrollment and employer-matching contributions. These tax incentives can help small employers make it more affordable to start a plan and incorporate automated features.

Find more details about the tax credits, including a worksheet to help calculate the possible tax credits (PDF). It’s always wise to consult with your tax advisor for all the details.

When cost is a concern, it might be time to make some changes to the plan design. It’s encouraged to reassess the current plan formula, asking:

- What are the goals for the retirement plan?

- Is it a shared responsibility for funding the retirement plan, or should it be weighted toward the employee?

- Why do you have the current formula?

- What is the budget as a percentage of compensation?

In these discussions, plan sponsors should consider not only direct costs, but also the indirect financial impacts—such as high employee turnover, loss of in-demand skills, unfilled positions, and delayed retirements. These factors can significantly affect the organization’s overall financial health. A thoughtful plan redesign can help manage the cost of automated features in a cost-neutral way, while also aligning with the plan sponsor’s broader goals and objectives for offering a retirement plan.

Eighty-eight percent of financial professionals and 76% of employers believe that automatic enrollment features will be required within all employer-sponsored retirement plans by 2030.

The need to redesign plans for automated features may come sooner than many realize. SECURE 2.0 contains a provision requiring that most new 401(k) and 403(b) plans include automatic enrollment with an annual auto-increase of at least 1%.

Get more data-driven insights: The power of automated 401(k) plan features

Find the latest on plan design, retirement legislation, and pension plans from Principal® thought leaders. Uncover additional ways to use the retirement plan as an incentive that works for your business and seeks to help your employees save more. Get more insights.

It’s important to work with a retirement service provider who understands retirement and has the expertise to consult on options to help deliver your desired results. If you’re looking for options that could work in building a more robust retirement plan—reach out to your Principal® representative.