A significant shortage of registered nurses is projected through 2036. As health care administrators face challenges in both hiring and retaining nurses, there are opportunities to offer enhanced employee benefits to reduce nurse turnover.

Nurses are in high demand, and it doesn’t look to be letting up any time soon. Health care organizations not only need more nurses but also want them to stay longer, appreciating the significant contributions they make to patient care .

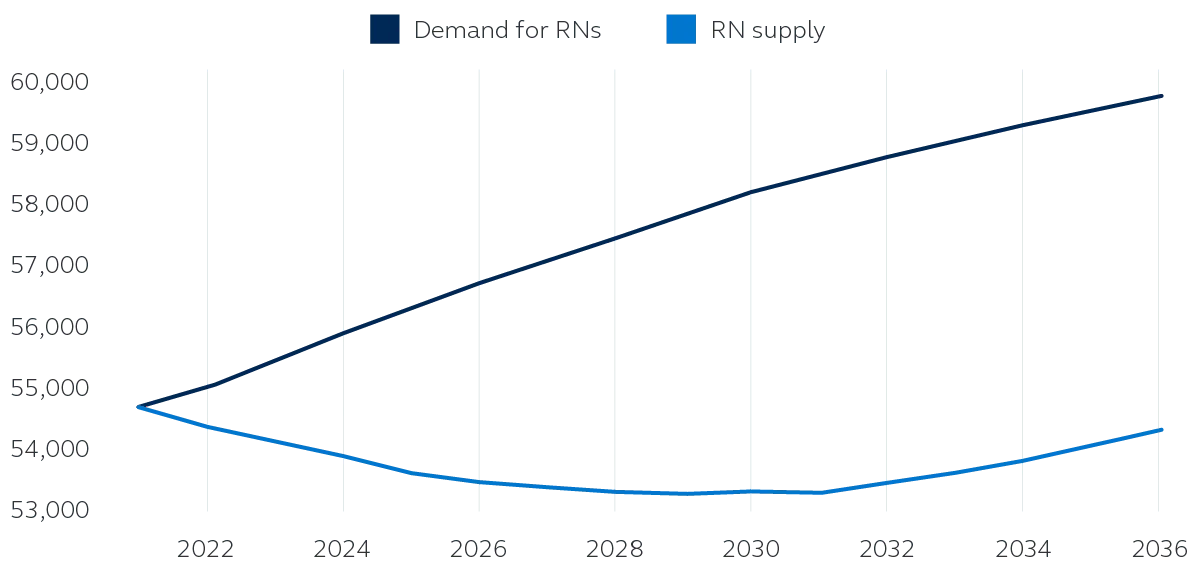

The supply and demand of registered nurses 2021 - 2036

Department of health and Human Services, Health Resources and Services Administration, Health Workforce Projections. https://data.hrsa.gov/topics/health-workforce/workforce-projections (Under Occupation, select Registered Nurses).

Nurse turnover accelerated by pandemic

The median age of RNs decreased from 52 in 2020 to 46 in 2022 as approximately 200,000 RNs retired or left nursing during the global pandemic. Roughly another 800,000 RNs report an “intent to leave” (retirement or leaving the profession entirely) by 2027. This presents a challenge for health care administrators looking to hire nurses as the number of projected RN graduates is not enough to backfill those leaving or meet growing demand.

The cost of nurse turnover

Health care leaders often say that if they can get a nurse to stay for the first two to three years, they will likely stay for the length of their career. When a nurse leaves employment the impact resonates, affecting full-time staff, patient care, and overall health care costs. According to the 2024 NSI National Health Care Retention Report, the average hospital turned over 102.6% of their RN workforce in the past five years. The same report states that the cost of turnover for an RN averages between $45,100 and $67,500, with a time to hire a replacement of roughly 86 days.

Tackling nurse turnover with enhanced benefits

There are ways to help reduce turnover. The first thing is to dig into your specific cost to replace a nurse. This budget can be significant for many healthcare organizations. If each open RN position costs roughly $50,000 to replace, a quick look at the career page of a healthcare provider will be eye-opening. With average turnover over 100% in a five-year period, many of these RN positions must get filled again and again. If an organization has 100 open positions, that's roughly $5M they may need to spend on hiring, training, lost production, overtime, traveling nurses, and more. Instead, work with human resources and benefits advisors/consultants for ways to proactively redirect some of that budget towards nurse retention efforts.

Ways to help reduce nurse turnover:

- Student loan repayment assistance

Given the educational needs of the healthcare workforce, student debt weighs heavily on their budget. Updated legislation (SECURE 2.0) lets employers match student loan payments with contributions to the employee’s retirement account. - Sign-on bonuses

These should have a repayment period if someone leaves, to influence not only recruitment, but to encourage as much tenure as possible. - Retention bonuses

Use data to encourage a length of time where the bonus outweighs the cost of turnover. - Combined bonuses

Consider using a sign-on bonus and retention bonus together to both provide quickly attainable benefits and longer retention. For example, if a healthcare organization wishes to keep nurses beyond three years, they could provide a sign-on bonus that would need to be paid back until the person worked at least 12 months, combined with a retention bonus that pays out at 24 months and again at 36 months. The idea being to provide easily attainable benefits that are always close to paying out. - Home down payment assistance programs

A unique spin on retention bonuses, this can have the added benefit of nurses establishing roots in the community. - Enhanced retirement benefits

Consider alternative structures, such as match contributions that increase with service or a combination of age and service to reward industry experience. Some nurse positions may even be eligible for non-qualified plan benefits. They could also see an advantage from the addition of a post-tax contribution allowed within the plan, to enable backdoor Roth contributions.

Collaborate with a health care retirement professional

Properly benchmarking and understanding the competitive situation an organization faces can be a great first step. It’s important to understand what the organization may need to provide in order to properly recruit and retain the talent they need.

Using the ideas above, there’s an opportunity to implement a targeted benefits strategy to help improve your recruiting efforts, improve the quality of patient care, support nurses’ financial well-being, and enhance the overall resilience of the organization.

Health care is an intricate business, and encouraging nurses to stay with your organization can be challenging, but it is possible. It’s important to work with a retirement service provider that understands and has the expertise to consult on options to help deliver the desired results.

Discover more retirement research and insights

Find the latest on plan design, retirement legislation, and pension plans from Principal® thought leaders. Uncover additional ways to use the retirement plan as an incentive that can work for your business and helps your employees save more. Get more insights.

If you’re looking for options that could work in building a more robust retirement plan—reach out to your Principal® representative.