2. Your glidepath

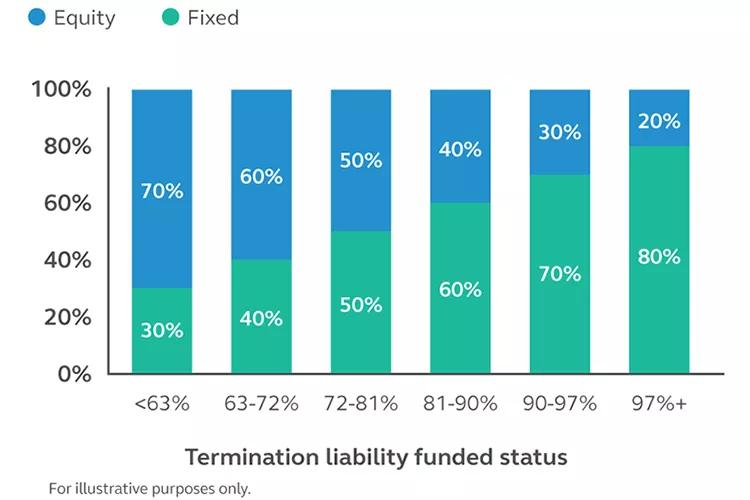

If you’re using dynamic asset allocation, set up triggers to monitor its progress and take action on a regular basis. Is your funded status improving? Are you locking in gains as they happen? If you’re not meeting your goals, talk with your financial professional and actuary about whether adjustments are needed.

3. Your asset allocation and your liabilities

Not using dynamic asset allocation? Consider an asset liability modeling study to chart DB assets and liabilities and to help you evaluate the pros and cons of various asset allocation strategies. Inquire with your actuary about the benefits of asset liability modeling.

4. Your investment performance

The more closely your bond duration matches your liability duration, generally the less sensitive your plan’s funded status will be to interest rate fluctuations. As the name implies, liability-driven investments (LDI) are specifically suited to this task. But if LDI isn’t an option for your pension plan, you may want to look at your asset mix.

5. Your costs

Are your plan fees in line with the services you’re receiving? Have you considered strategies to reduce PBGC premiums? Some costs and fees are fixed, but others fluctuate. Discuss with your financial professional and actuary during regular pension plan reviews.

6. Your plan design

During regular plan reviews, check that your plan design still meets your organization’s needs. Ask the following questions:

- What are your goals for the plan?

- Are you providing an adequate amount of benefits for each employee (taking into account any other retirement plans you may offer)?

- Is the plan costing you more than expected?

- Are you taking on more liability than intended?

How you answer may determine if you want or need to change your benefit formula, your asset allocation, or your plan design by: converting to a cash balance plan, soft freezing the plan or hard freezing the plan with the intention to terminate it.

7. Analyze the current environment

Your plan can be impacted by countless outside forces. It’s wise to keep an eye on three major risks that can impact both the cost of administering your plan and its ability to meet liabilities:

- Changing mortality assumptions: As life expectancies increase, so can pension obligations and PBGC premiums.

- PBGC premiums: Premiums have continued to increase.

- Interest rate changes: While rising interest rates can lower pension obligations, the reverse is also true. A 1% change can impact plan liabilities by as much as 10 - 15%.

We can help

No single strategy is right for every organization. We can help you and your financial professional objectively evaluate your options, make an educated decision, and create tangible action steps you can use to help reach for your unique goals. Give us a call at 800-952-3343 or contact your financial professional to get started.