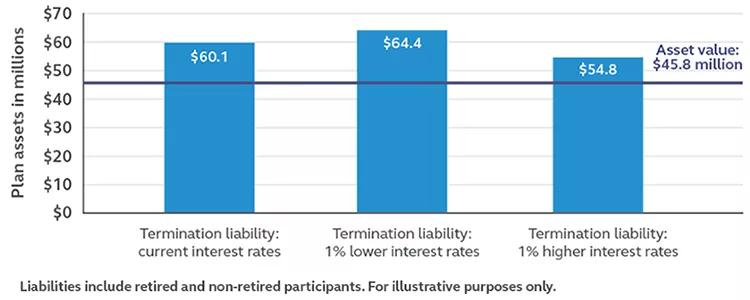

As you can see, higher interest rates result in lower liabilities. But the reverse is also true—lower interest rates increases the liabilities. While the amount of increase or decrease can vary based on the ages of plan participants and the benefits being offered, generally a 1% change in interest rates can affect liabilities by 10 to 15%. That’s why it’s so important for your actuary to calculate the possible amount of plan assets required to terminate your DB plan using a variety of interest rate assumptions.

Covering a funding shortfall

In the graph shown above, the estimated amount of plan assets required to terminate the plan is higher if all plan participants get annuities (rather than non-retirees choosing a lump sum distribution). In addition, even assuming lump sum distributions are paid where allowable, the estimated amount required to terminate is more than what’s needed to fully fund the plan under the funding rules for an ongoing hard-frozen plan.

Based on the current interest rates (1st column), the estimated shortfall is $14.3 million on a termination basis (assuming lump sums are paid to non-retired plan participants)—the difference between the total liabilities of $60.1 million and assets of $45.8 million.

Knowing the spread between plan assets and liabilities on a termination basis will help you decide whether you can afford to fund the shortfall over one 1, 5 years or some other period. Depending on your risk tolerance and your organization’s access to capital, you may choose to fund the shortfall through contributions, investment earnings or a combination of the 2.

We can help

Our DB team at Principal has the experts that can help you meet your needs. Give us a call at 800-952-3343 or contact your financial professional to get started.