You value your key employees. Here’s how to help create a benefits plan that rewards them—and helps you achieve your goals, too.

While every employee is valuable, some—your key employees—may be more critical to the business than others. Key employees can be found in every role, from administrative to management. They may be a particularly talented salesperson, for example, a leader in the technology space, or someone skilled at design.

Your growth and business plans may focus heavily on those key employees’ talents, and your worries may too. What would you do if that person left? You’re not alone: An April 2024 Principal survey of small and midsize businesses (SMBs) found that 93% rank retaining key employees as an important business issue.

A thoughtful key employee benefits plan can help allay those worries. It typically has four focuses:

- Recruit top talent.

- Reward (and motivate) key employees with performance-based incentives that help achieve business goals.

- Retain key employees by helping them achieve financial goals.

- Diversify long-term income for key employees so they can retire with confidence.

To address each of these four goals, consider these four questions to craft a key employee benefits plan that fits your business and employee goals.

What industry-specific benefits work for your recruitment goals?

It helps to know what your key employees' typical expectations, wants, and needs are. Factors including your industry, employees’ specialty and expertise, the competitive landscape, and your location all affect the holistic key employee benefits plan you create.

“You’re really competing with everyone in the current environment,” says Amy Friedrich, president, benefits and protection, Principal Financial Group®. “The more you understand what other employers are offering out there, the better positioned you’ll be to hire and keep top talent.”

If you’re competing in a hot labor market for big-value skills or roles, you may have to adjust your key employee benefit plan to reflect that. Also consider your opportunities for remote work and accommodations for regional costs of living.

What performance-based incentives can you use?

Performance-based incentives benefit not only your key employees, but you as well. You may set up a bonus plan rewarding meeting certain milestones by the employee, the company, or both. While some incentive-based compensation has traditionally been offered to more senior employees, opening it up sooner and to younger employees helps them feel more invested in the organization. This is especially true if you have a knowledge-based business that may offer future partner opportunities. That incentive pay helps those employees to focus on growth as well as longevity.

How can you structure a total compensation package to ensure you retain valuable key employees? Nate Schelhaas with Principal offers some ideas.

Remember: Key benefits packages can be structured to help achieve your unique goals regardless of whether your organization is for-profit or tax exempt. Some offer tax benefits for your business, while others do the same for employees. Others may allow for employee deferrals, discretionary employer contributions, or both.

How can you impact key employees’ financial futures?

Your key employees are as worried about their futures as you are. In a key employee benefits plan, offering tools to help ensure financial security is essential.

One option is an individual life insurance and/or disability insurance policy on key employees, which can benefit both the business and the key employee. Here’s how this benefit works: The business purchases a life insurance or disability insurance policy on the key employee and pays the premiums. If the employee dies or becomes too sick or hurt to work, the business receives a policy benefit. If the key employee leaves the business or retires, they may assume the policy payments and continue the coverage.

Key employee life insurance policies come in many forms, including split-dollar life insurance. In that case, your business and the key employee split the cost of the policy, with opportunities for loans for the employee. Check with your financial professional to help determine which type of coverage might make sense for your needs.

How can you diversify income for key employees to help them meet retirement goals?

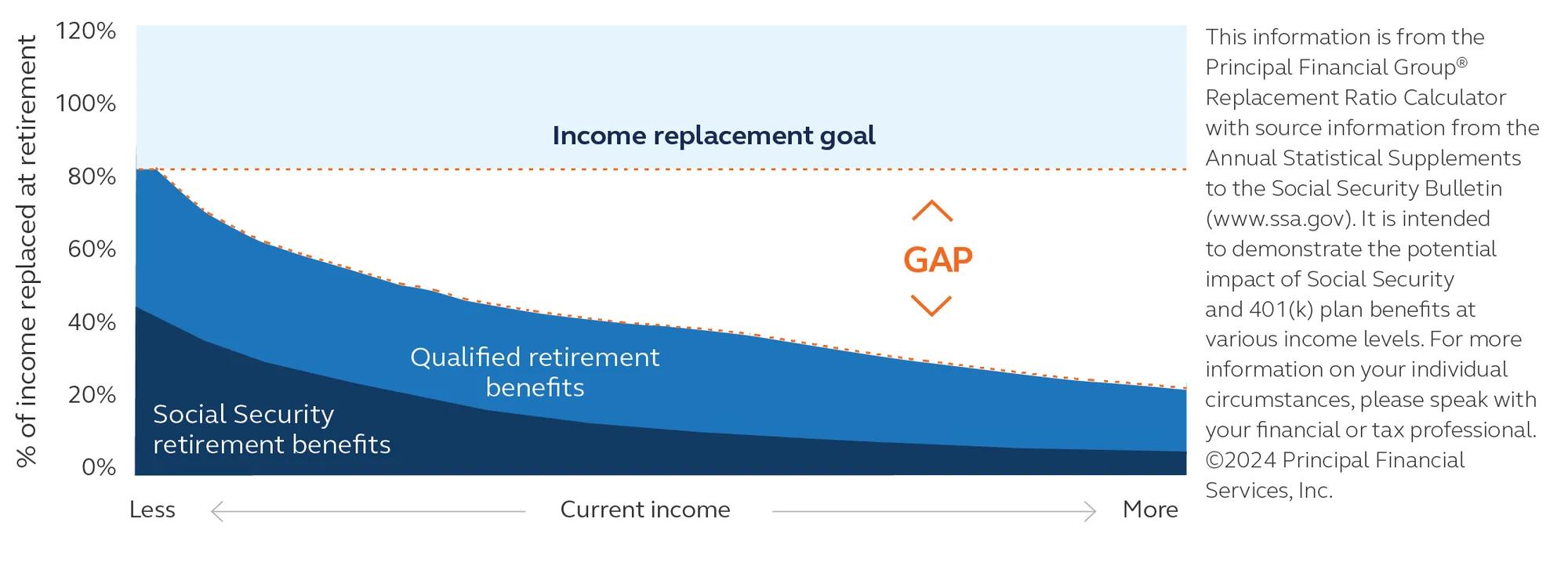

Key employees planning for retirement may struggle with how they’re going to make up the income replacement gap. That’s the difference between what they’ve been able to save and what they think they might need in retirement. Benefits focused on boosting retirement savings can help.

For example, 401(k) plans and individual retirement accounts (IRAs) have yearly contribution limits. Plus, qualified plans may be subject to coverage and non-discrimination testing that can limit the amount of employee and employer contributions to the plan. A business may add a nonqualified deferred compensation plan, which allows the key employee to decide how much of their pay or bonus is deferred, and until when. The employee also avoids paying income tax until the deferred compensation is received—a potential retirement benefit if their income bracket is lower at that time. This benefit is often tied to a certain vested period of time for the employee; employers can also contribute to these plans for key employees.

“The nonqualified plan at Shaw allows employees that are eligible to set aside some income and let it grow in a retirement plan,” says David Morgan, executive vice president, operations, Shaw Industries, a Principal client, in Dalton, Georgia. “It gives them a second platform to grow financial wellness over time.”

What’s next?

Find the benefits that fit your key employee retention goals.