Defined benefit plan sponsors can save on their PBGC premiums.

Defined benefit plan sponsors have felt the increases over the past decade in the premiums for Pension Benefit Guaranty Corporation (PBGC) insurance, which Congress sets through legislation. But here are two possible ways these plan sponsors can reduce PBGC premiums.

The potential savings can be significant. Depending on a plan’s funding level and liability characteristics, sponsors can save up to 10% on their 2024 PBGC premiums. Plans using the Pension Protection Act (PPA) funding valuation option may even be able to refile their 2023 PBGC premiums, saving as much as 20%.

Option one: change to the standard PBGC filing method

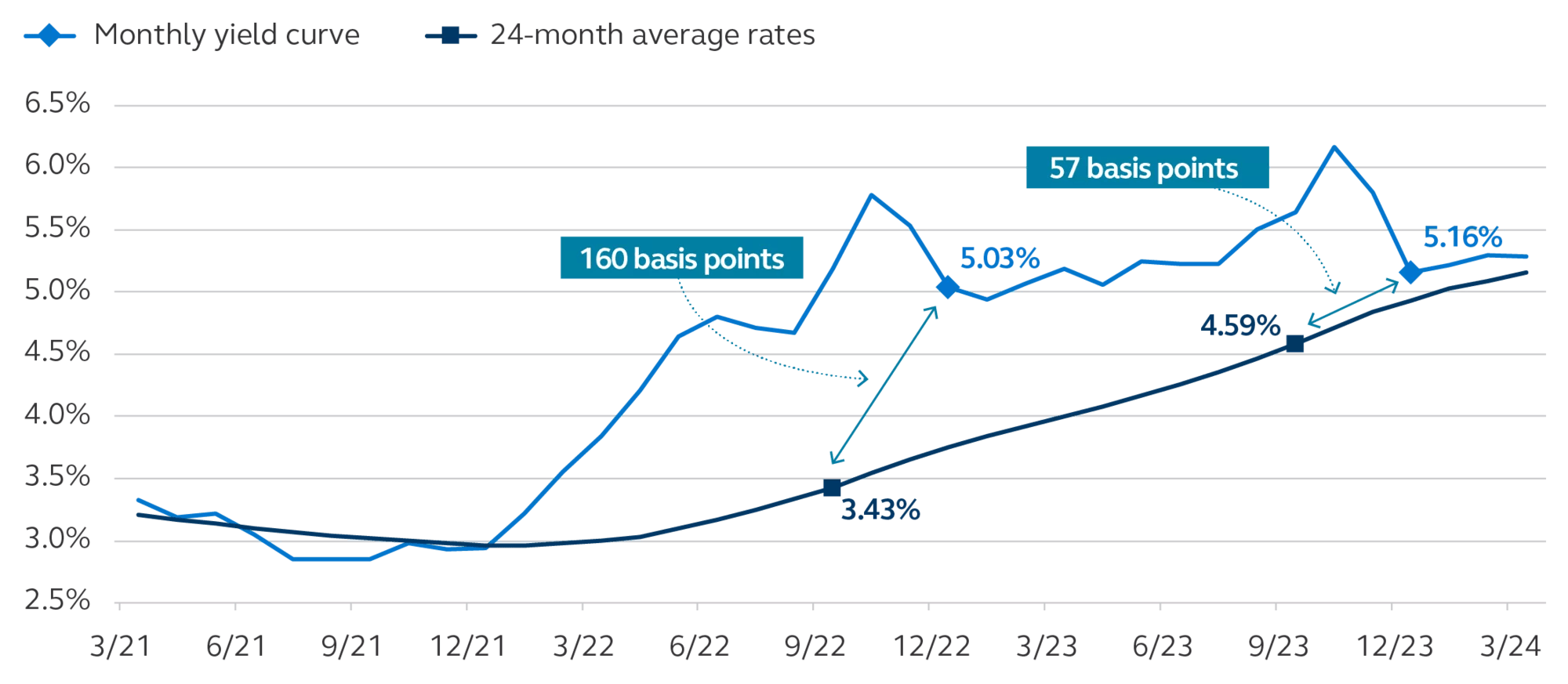

The simplest way for a plan sponsor to reduce PBGC premiums is to elect a change to the PBGC filing method used to determine the variable rate premium—if they haven’t changed filing methods in the past five years. Assuming a calendar-year plan for a sample plan (shown below), changing from the alternative to the standard filing method in 2024 increases the discount rate used in the liability calculation by approximately 57 basis points, which can reduce liabilities by as much as 10%.

Election of the PBGC standard filing method is reported through the comprehensive premium filing for the plan year. The deadline for a Jan. 1, 2024, valuation is Oct. 15, 2024.

Option two: use the PPA monthly yield curve

The PBGC alternative filing method uses the same liability basis as the PPA funding valuation, so a change to the monthly yield curve for minimum funding purposes can reduce the PBGC liability indirectly as well.

The PPA allows sponsors to adopt the “monthly yield curve” to value PPA funding liabilities or the 24-month average rate. Most plans use 24-month average bond rates for PPA minimum funding.

Changing to a monthly yield curve can provide a 160-basis point increase for a Jan. 1, 2023, PPA funding valuation, which can reduce liabilities by up to 20%. The difference for 2024 can still be significant at 57 basis points.

This is potentially attractive for plan sponsors who changed their filing method in the last five years since this does not technically change the PBGC premium filing method. Sponsors are permitted to refile 2023 premiums using the lower yield curve-based liabilities.

The window to switch to the monthly yield curve method appears to be closing. As the chart shows, the two liability interest rate measures have converged, so the benefit of switching methods for 2025 is expected to be much less significant (if it exists).

If you change PPA calculations to the full yield curve, future changes are not automatically approved. Plan sponsors should consider the long-term impact this election can have on their liabilities because the change is considered permanent. The impact of a full yield curve on their liabilities can instead be mitigated through liability-driven investing (LDI) strategies.

Plan sponsors who want to adopt the monthly yield curve for their PPA funding valuations have until the corresponding plan year's IRS Form 5500 filing date. This Jan. 1, 2023, valuation deadline is Oct. 15, 2024 (assuming an extension has been filed).

Options for plan sponsors to consider for lowering PBGC premiums

| Have switched filing methods in the past five years | PBGC filing method | PPA funding basis | PBGC variable premium | |

|---|---|---|---|---|

| Current situation | Alternative | 24-month average | Higher | |

| Option 1 | Standard | 24-month average | Up to 10% lower for 2024 (based on example) | |

| Option 2 | Alternative | Full yield curve | Up to 20% lower to refile 2023 AND 10% lower for 2024 (based on example) |

There are potential PBGC premium savings noted on the table and the window of opportunity is still open. But there are long-term impacts to consider and all plans have their own characteristics, so when considering changing a PBGC or PPA filing method, review your options with your Principal® representative to consider these strategies.