Impulsive online shopping. Lacking an emergency fund. Running on empty when payday is just around the corner. It doesn’t necessarily put you behind financially, but you might not get ahead either.

Sound familiar?

“I’d estimate that more than half of people in their 20s deal with some mix of impulsive spending and a lack of savings,” says Stanley Poorman, a financial professional with Principal®.

Workers who have access to a defined contribution retirement plan, yet don’t participate.1

Workers who participate in an employer-sponsored retirement plan yet feel they’re not saving enough.2

When you’re young and social, you may put big portions of your monthly paycheck toward lifestyle spending: dining, entertainment, travel. That’s all on top of the typical debt load for young earners—student loans, car payments, credit cards—making it easy to fall into a one-step-forward, one-step-back cycle.

But there are ways to find a sustainable balance of living in the now and planning for the future. Giving up the pleasures you work hard to earn may not be required.

Budgeting by paycheck

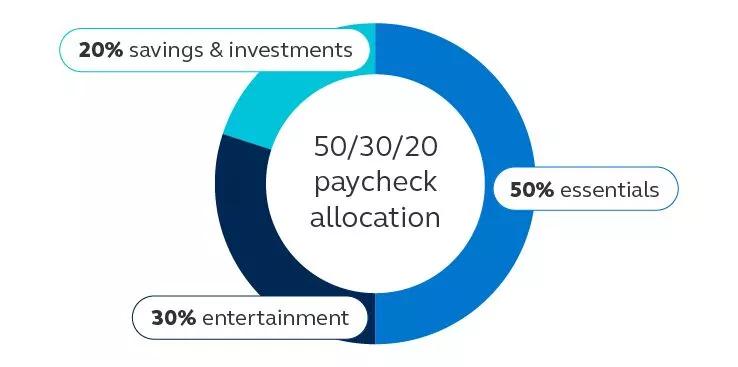

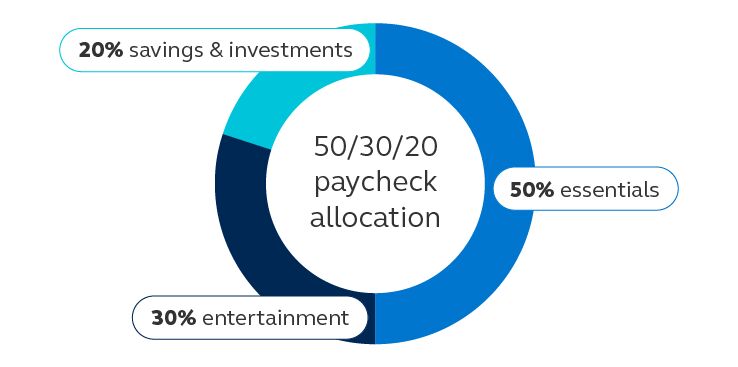

What does that balance look like? Poorman suggests the popular 50/30/20 rule of thumb for paycheck allocation:3

- 50% of net pay for essentials: groceries, bills, rent or mortgage, debt payments, and insurance

- 30% for spending on dining or ordering out and entertainment

- 20% for personal saving and investment goals

Let’s break it down: essentials first, savings and investments second, and entertainment third.

1. Keep essentials at about 50% of your pay.

Things like groceries, bills, rent or mortgage, debt payments, and insurance should make up about 50% of a net (after taxes) paycheck. Remove this money from your primary account right away, so you know your needs will be covered.

If you’re living in a high-cost area, Poorman notes you may have to shell out a higher percentage for essentials. Adjust accordingly.

2. Dedicate 20% to savings and paying down debt.

This is the part of your paycheck set aside to meet future financial objectives—whether they’re long-term or relatively short-term.

Put half of this toward retirement (about 10% of your pay).*

The priority here is to contribute enough to your retirement plan to maximize your employer’s match, if they offer one, and set yourself up to help meet your long-term goals. Poorman suggests a 10% contribution, then build from there.

The other half is your goal/debt money (about 10% of your pay).

Depending on your circumstances, how you use this money may change over time.

Initially, Poorman says to use it to build an emergency fund, so you aren’t dependent on credit cards to cover unexpected expenses. Set an achievable goal—say $1,000—and when you hit it, move on to saving one month of expenses (with the goal of having three to six set aside, which may take a few years).

With that one-month emergency goal hit, consider splitting your allocation to 8% for credit cards and 2% for the emergency fund. “Keep allocating to the emergency fund,” Poorman says, “but now that the one-month cushion is set, you can start tackling the credit card balance, too.”

To help avoid temptation, keep the emergency fund in a different place than your checking account. Maybe it’s at an online bank or a different financial institution (try bankrate.com to compare high-yield saving accounts). The idea is to modify your behavior by making transfers take longer, so you’re less tempted to use it on a spending splurge.

Financial planning is really more about behavior than numbers.

3. Use the remaining 30% as you please—but don’t track expenses.

Surprised? Well, it’s tedious. And people don’t tend to stick with tasks they dread.

“Financial planning is really more about behavior than numbers,” Poorman says. Adjust your priorities so that saving comes first and spending second.

Remove from your paycheck the money you need for living expenses and future savings with automated apps or bank accounts. It can be a mental shift, but when you know your financial goals are met, you can spend the remainder of your paycheck guilt-free.

If you’re worried you’ll go overboard on a shopping day or night out, consider giving yourself a cash budget. “Credit and debit cards make money abstract; it’s hard to get a mental grasp on cashflow when you don’t see the cash,” Poorman says. But with a cash budget, “the end of the cash is a hard stop.”

A strong financial future starts with a solid financial plan. Check out our simple guide to making yours.

What’s next?

How much are you saving for retirement? Log in to your Principal account to see how you’re doing and adjust. Don’t have an employer-sponsored retirement account or want to save even more? We can help you set up your retirement savings with an individual retirement account (IRA) or Roth IRA. Ready to learn more ways you can build your financial foundation? Our learning library can help.