If something happened to you tomorrow, are your loved ones prepared to handle your finances? Or would they spend days sorting your papers and tracking down information—amid an already difficult time?

Outlining and organizing personal finances—regardless of your life stage—is an act of love and consideration toward the people who matter most to you. Do it quickly and efficiently with our five-step plan.

Step 1: Gather important financial documents.

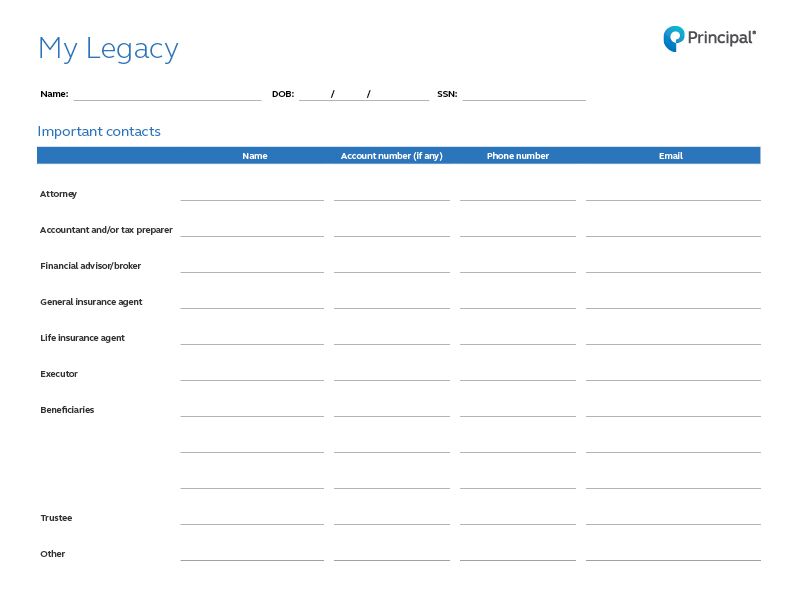

Use our downloadable estate planning sheet (PDF) as a guide.

What other financial papers are required after death? Check out our survivor’s checklist.

Step 2: Write down financial and legal information.

Document all account numbers, phone numbers, and special instructions using the planning sheet from Step 1. Never assume family members know who to call or what information they need. Put yourself in their shoes. Thinking through each scenario now helps eliminate guesswork in the future.

Make sure your assets end up with the people and causes you care about most. Learn how to make a will in 7 steps.

Step 3: Designate folders.

Choose a color for each section of your filing system. Suggested categories:

- Financial management

- Investments and retirement

- Insurance policies

- Personal documents

- Legacy

Step 4: Start organizing financial and legal files.

Stuff papers in their appropriate folders. Avoid clutter—store only what’s needed. For example, you don’t need every monthly bill or 401(k) statement from the past three years. The most recent month will do. You may have to keep tax records, on the other hand, for several years.

Step 5: Store and inform.

Stow your files somewhere secure, such as a fireproof safe or safe-deposit box.1 Tell two people you trust where to find it or leave that information with your financial professional. Set a reminder on your phone or computer to review and update information at least once a year.

Go digital

Even the best organizational method will fail if you don't utilize it. Not a paper person? Try a digital tool. Play around to see which one best suits your needs. Some common personal finance apps are Mint, YNAB (You Need a Budget), and Quicken. Still, store your log in information somewhere safe, and tell two people you trust where to find it.

What’s next?

If you haven’t named or reviewed beneficiaries for your financial accounts, do so now, while all the information is in front of you. Log in to principal.com to update this information, check on your retirement savings, and adjust your contributions as needed. First time logging in? Get started by creating an account.