Five doable retirement savings strategies can help you reach your goals for your post-work years.

Whether or not you have a retirement plan through work, you can start saving—or save more—no matter how close you are to your non-working years. These five retirement savings strategies may help you create a retirement savings plan that works for you.

1. Start saving for retirement as early as you can—even if it’s just a little.

There’s a saying: It’s time, not timing, that matters most when it comes to retirement savings. An early start on retirement savings may be one of the most important things you do. It can even make up for periods when you may not be able to save as much (or at all). Here’s why.

| Saver | John | Jane |

|---|---|---|

| Age of first retirement savings | 25 | 35 |

| Yearly investment | $10,000 | $10,000 |

| Investment length | 15 years | 30 years |

| Total invested | $150,000 | $300,000 |

| Total value at age 67 | $1,122,000 | $908,534 |

2. Save enough to get your employer retirement savings match.

If you’re lucky enough to work in a place with an employer-sponsored plan that offers a match, save at least enough to get the maximum match. It’s essentially free money when vested. A couple examples:

| Employee | John | Jane |

|---|---|---|

| Salary | $50,000 | $50,000 |

| % saved by employee | 6% | 3% |

| Match | 3% | 1.5% |

| Total yearly retirement savings | $4,500 | $2,250 |

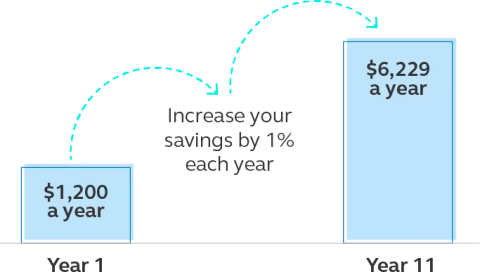

3. Regularly increase your retirement savings.

One retirement savings strategy to build what you’re putting away is to increase contributions over time. Even a small percent—say just 1%—every year, until you get to where you want to be, can make a big difference. For example:

Start saving 4% of a $30,000 salary at age 30 for a total of $1,200 in retirement savings that year.

In 11 years, you'll be saving a whopping 15% and a total of $6,229 each year.

4. Diversify your investments.

Just over one-third of all working-age people have access to an employer-sponsored retirement account

In addition, you may want to have more than just one place you think about putting money away. Contributing to a 401(k) and opening your own IRA may enable you to widen the investment offerings you’re able to save in, creating diversification, which helps spread out your risk and buffer the impact of market volatility.

5. Use catch-up retirement contributions to make up lost ground.

Some years, competing financial goals or unexpected expenses may demand a change. But if you make retirement a priority, over time, you’ll take advantage of consistent saving. And there’s a way to make up for times when you couldn’t save as much as you wanted to: catch-up contributions. These are extra dollars that you can save each year once you reach age 50 and have made the maximum for your yearly contributions.

| Age | 50 | 55 |

|---|---|---|

| Catch-up contribution | $6,500/year | $6,500/year |

| Value at age 67

|

$246,079 | $147,143 |

What's next?

Do you know how much you’re contributing to your employer-sponsored retirement account? Log in to your account to check. First time logging in? Get started by creating an account. Don’t have an employer-sponsored retirement account? We can help you set up your own retirement savings.