An annuity can serve as a key part of a retirement income plan, generating guaranteed income and making budgeting simpler.

How confident are you in your ability to create a retirement income plan that protects against future unknowns? If you’re like more than a third of Americans, the answer is “not very” or “not at all.”

One thing that can help increase your retirement confidence is focusing on guaranteed retirement income. Guaranteed income is money you can count on--the same amount, year to year, and throughout the length of your retirement. It typically comes from three sources: Social Security, a pension, and an annuity.

Social Security, at its current levels, only replaces about 40% of a person’s income.

Your retirement income plan starts with a retirement budget.

Financial planning in retirement isn’t all that different from financial planning in pre-retirement: Both start with a budget. To create a retirement budget, start by totaling fixed expenses, such as housing and utilities, as well as flexible expenses—travel and clothing, to name just two. Estimates are fine, and know that your expenses might change over your lifetime.

Then, add up all your sources of guaranteed retirement income. (Remember, those are Social Security, pensions, and any annuities you may already have.) Are your retirement income expenses more than your guaranteed retirement income? If so, you have a retirement income gap.

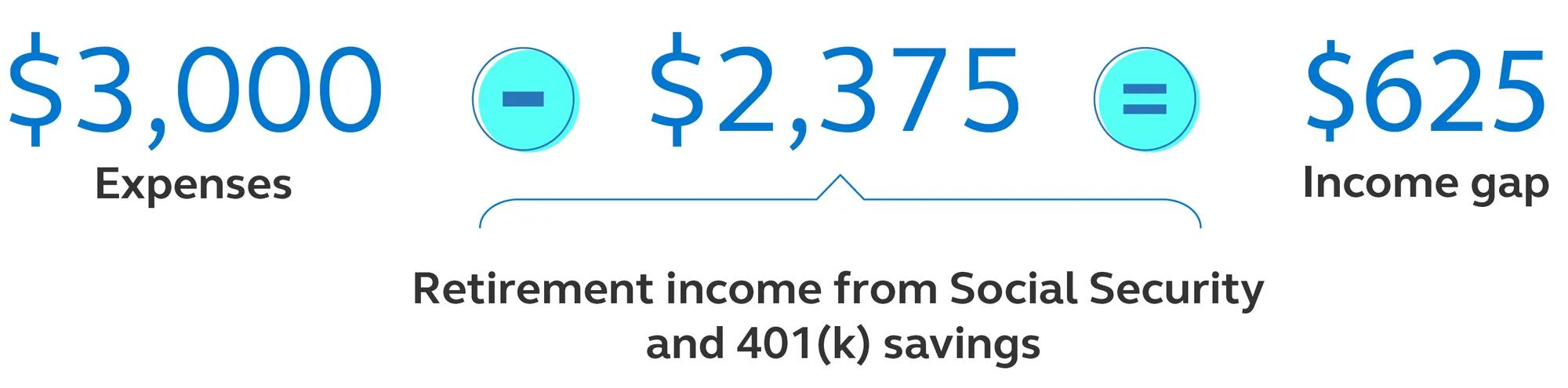

Here’s an example: Say your fixed expenses—housing, insurance, food, etc.—add up to $3,000 a month. Your guaranteed retirement income is $2,375 from both a pension and Social Security. That leaves you a retirement income gap of $625 per month. This means you have less than you need in guaranteed funds to pay the bills you expect in retirement.

What about variable retirement income?

For some retirees, there may be another source of retirement funds: variable retirement income. Variable retirement income may include current or future work plans in retirement as well as withdrawals from savings or retirement sources such as a 401(k) or IRA. But variable retirement income is just that: It may change from month to month based several factors, such as how the markets are doing. Some people try to reserve variable retirement income for flexible or unforeseen expenses such as travel or an emergency.

Using an annuity in your retirement income plan

Budget planner (PDF)

This interactive retirement income budget planner can help you get started.

To fill the retirement income gap, you have to create more sources of guaranteed retirement income gap that you control. While you can find out what your estimated Social Security benefits may be, you can’t change them. And, as mentioned, pensions aren’t typically available to most people. That’s where an annuity can come in.

An annuity acts almost like a pension: You fund it—typically over time or with a one-time amount—and then once you reach retirement age, you receive a guaranteed monthly amount. It’s a way to build certainty in your retirement budget.

What’s next?

Which annuity may fit into your retirement income plan? Check out the differences between variable and registered index-linked annuities.