As you switch from saving for retirement to learning how to spend in retirement, some withdrawal strategies can help you figure out what works for you.

Your whole life, you’re encouraged to save: for emergencies, big events, homes, college—and of course, retirement. But once you finally reach retirement age, the reverse is true. Now, you have to figure out how to spend.

It’s a pivot that’s so important, it’s got a name: the retirement consumption puzzle. People find themselves confused. How cautious should they be so that their retirement savings last? If they’re too cautious, might they miss some joy in their post-work years?

A reluctance to spend in retirement is natural. Uncertainties, from your health to the state of the markets, are in no short supply. But in place of caution, there are strategies to figure out a retirement spending plan that works for your savings and your goals. Here’s how to get started.

You may have heard the term “decumulation”; that’s simply the shift in retirement from accumulating savings to spending down the assets you have. The problem is, nearly half of all retirees don’t have a plan for using what they’ve saved; instead, they say they’ll use it when they need it.

The fear of spending makes sense, of course: It’s hard to suddenly switch from saver to not (and watch account balances decline), especially when there’s no regular job or paycheck. That’s why, before you pick a retirement spending strategy, it’s helpful to understand a few influences, including:

- Budget: This may change year to year based on plans and goals, as well as factors like healthcare costs and how late in life you work.

- Taxes: This may also change, and withdrawals from different retirement savings accounts have different tax implications.

- Expected retirement length: You can’t know this for certain, but you can make a guess. One recommendation is to plan for a 30-year retirement.

- Inflation: Costs for what you need and what you want generally go up every year, so your withdrawal (and budget) may have to increase, too.

- Potential growth or loss of remaining savings: Hopefully, you take out only a portion of savings, and what remains may have growth potential, depending on the market.

The most common retirement withdrawal strategies are fairly straightforward. Those withdrawals may be from one or from several sources such as a 401(k), IRA, annuity, other savings, cash, and a Roth IRA.

Once you pick the retirement withdrawal strategy that you feel suits you best, it’s important to know you can change if you need to. Or, you can try one, see how it works, and try a different one the next year.

But remember, “your plan for retirement should be designed to meet your needs and wants in the long term,” says Heather Winston, a financial professional and product director with Principal®. “But more than that, your plan for retirement is uniquely yours.”

It’s a super common (and super simple) retirement spending strategy: Establish a fixed percent to withdraw in your first year of retirement. Each year after that, add an increase (say, 2%) to accommodate inflation. Conventional wisdom used to be a 4% withdrawal rate as a baseline, but you may not need that much. And, if your initial withdrawal rate is too aggressive, you may run the risk of quickly depleting your savings.

Think about: Use your retirement budget to establish the lowest withdrawal percentage you can for the first year. Did it work? Or did you miss out on plans? If so, adjust in the following year.

Instead of a fixed percent, this retirement spending strategy suggests withdrawing a fixed amount in line with your budget. This may not account for inflation, and, if the total is too much, may run the risk of drawing down your savings too quickly.

Think about: As with the fixed percent strategy, establish the lowest total you can for the first year. Then, evaluate and adjust as necessary.

This retirement withdrawal strategy suggests taking out a fixed amount or a percentage from a single account—typically one with the most beneficial tax implications (see below)—until it’s depleted; then you move on to the next retirement savings account.

Think about: Depending on your age, you may have to withdraw from multiple accounts to fulfill your required minimum distributions. Your financial professional and tax advisor can help.

This strategy is more complicated. To do this, you bucket each type of retirement savings—cash, bonds, and stocks—to take care of a specific need in retirement. Cash pays for your immediate expenses, bonds work for goals in a year or two, and stocks are retained to continue to grow and for longer-term needs.

Think about: A financial professional can help you decide if you have enough in each bucket to successfully transition to your retirement spending plans.

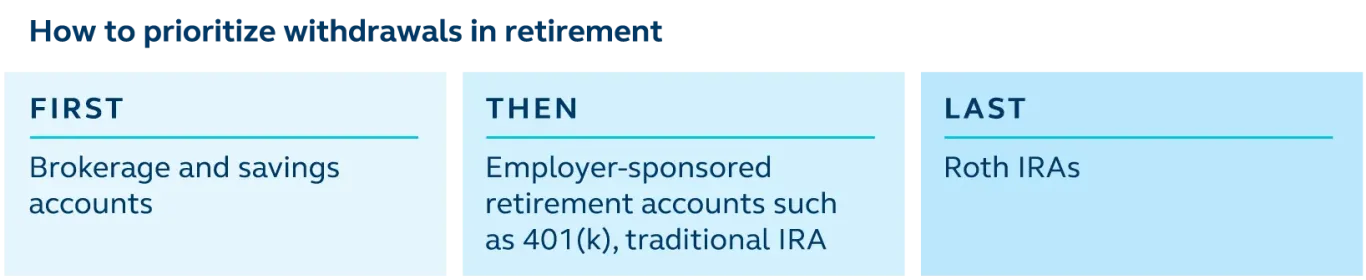

Before you withdraw anything for retirement, it’s critical to figure out the tax implications. Your goal is to withdraw from taxable accounts first and to maximize tax-free growth. To do that, financial professionals generally recommend prioritizing withdrawals in this order: brokerage and savings accounts, then employer-sponsored retirement accounts such as 401(k), traditional IRA, and finally Roth IRAs.

What’s next?

Have you reached retirement age and need to figure out your RMD from your Principal retirement savings account? Log in to view your dashboard and information on each Principal account you have.