Bonds may be part of nearly everyone’s retirement invest mix. In fact, the bond market is huge—bigger than the stock market.1 Even so, most people don’t know that much about bonds. Learning a few bond basics, however, can help you understand why they’re important to diversifying your retirement savings.

A bond, explained

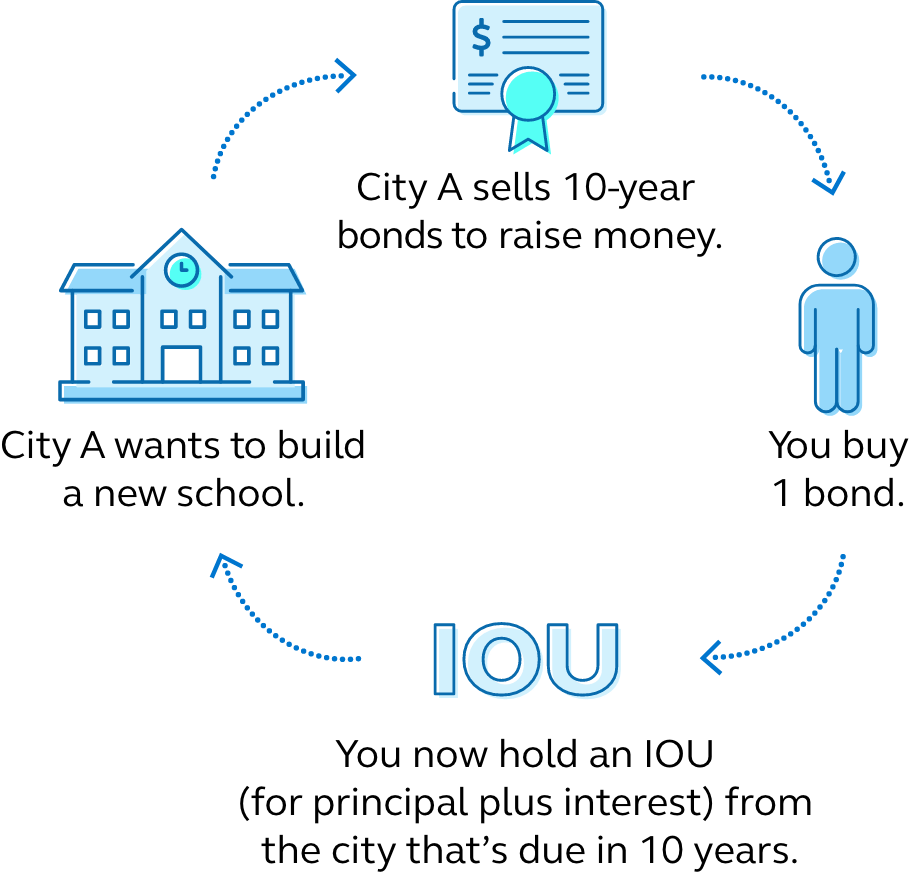

A bond is a loan: When you (or an investment fund) buy one, you’re lending that money to a government or company, which uses the funds for various reasons. Bonds are like stocks in one way: You can buy them at any time. But you generally must keep bonds until they reach what’s called a term, at which point you’re paid back the amount of the loan, or bond, plus interest.

Bond basics

A few simple terms can help you understand bonds, and how bonds are different from stocks. For example, unlike stocks, bonds have specific maturity dates at which they are paid back.

ISSUE DATE: Date the bond is sold.

FACE VALUE: The bond’s principal value.

BOND MATURITY DATE: Date the bond principal is due; it’s fixed and can be as short as a few days or as long as 30 years.

COUPON RATE: Annual interest rate paid on a bond; can be fixed or floating.

WHAT YOU EARN FROM YOUR BOND: Face value (principal) plus interest. The bond return is guaranteed unless there’s a rare case of bankruptcy or default.

How a bond works

How do you buy a bond?

You can buy an individual bond, of course—but you’ll likely never need or want to. Instead, the savings in your retirement accounts are invested in funds that include bonds or bond funds. That’s how an investment manager can diversify assets to spread out risk over time.

What are the types of bonds?

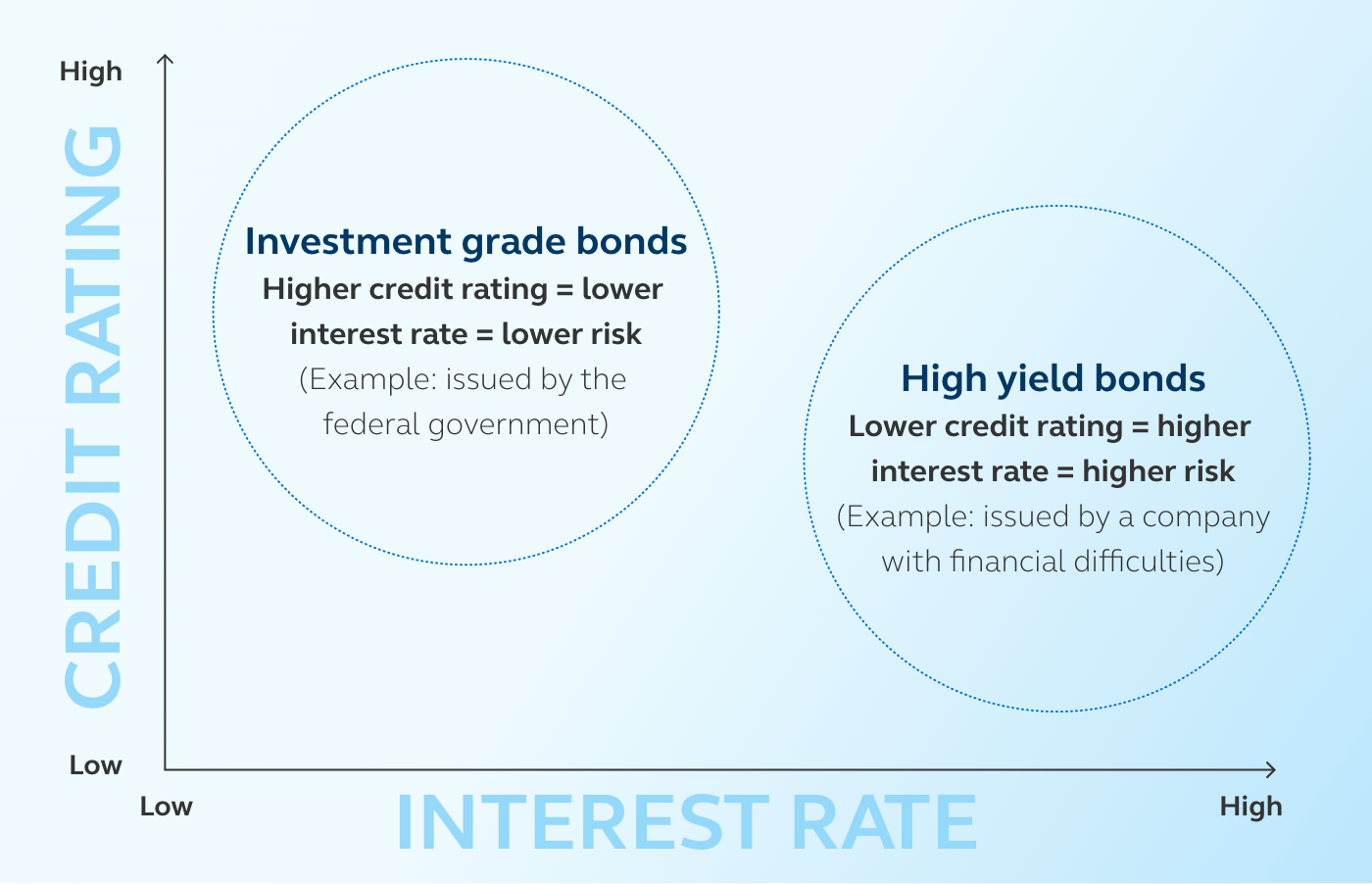

Are bonds risky? It depends.

Got a paper bond? That’s almost an antique. While many Americans used to buy savings bonds, especially education savings bonds, the physical bond program was discontinued in favor of a digital program in 2012. And U.S. savings bonds were earning super-low interest rates—just 0.1% (you read that right) as of early 2022. However, you can still redeem paper bonds by visiting the U.S. Treasury site.

Next steps

- What does your asset allocation look like? Log in to principal.com. First time logging in? Get started by creating an account. Don’t have retirement savings through your employer? We can help you set up your own retirement account.