Understand the factors that make up a credit score and know how to check your credit report to help build your financial foundation.

Key takeaways

- Credit is simply an amount that a lender such as a bank or credit card company agrees to let you borrow. How much you pay for your credit, i.e. your interest rate, is impacted by your credit score.

- Your credit score can also affect your ability to do things like rent an apartment or get a job. You can take steps now to maintain or improve your credit score.

- Regularly checking in on your credit and credit score with a credit report can help protect yourself from identity theft and fraud.

Credit, credit scores, and credit reports are all interconnected pieces of a puzzle that help you do big-picture things—rent an apartment, obtain a credit card, buy a house—to help reach your financial goals. Some things impact your credit, credit scores, and credit report more than others, but understanding all three is essential to help you make the best money decisions, big and small, for you.

What is credit?

Credit is simply your ability to borrow money—obtaining a loan or qualifying for a credit card, for example. To obtain credit, you typically have to apply for it. Once you’re approved for credit, an institution such as a bank will extend a certain dollar amount of credit and establish repayment terms including interest rates and minimum payments (typically a fixed amount or percentage of a loan).

Credit isn’t free; there are always costs such as interest rates on the principal you borrow or fees charged when you applied. And the credit you’re able to obtain changes over time. Typically it grows as you increase your income and demonstrate your ability to regularly pay it back.

What is a credit score?

Think of a credit score as a report card for your finances. It is a number that measures how well you’ve been able to borrow and repay money—in other words, whether you pose a risk to lenders, demonstrate reliability to pay bills, or can pay back money you borrow. The higher your credit score, the lower the perceived risk you pose.

Credit scores are made up of a variety of finance-related factors including:

- Bill paying habits: Do you pay your bills on time?

- Credit utilization: How much of your credit do you use?

- Credit age: How long have you had credit, and how old are the debts you have?

- Credit mix: What types of credit—a loan, a credit card, for example—do you have?

- Credit requests: How often and when have you applied for new credit?

What are credit score ranges?

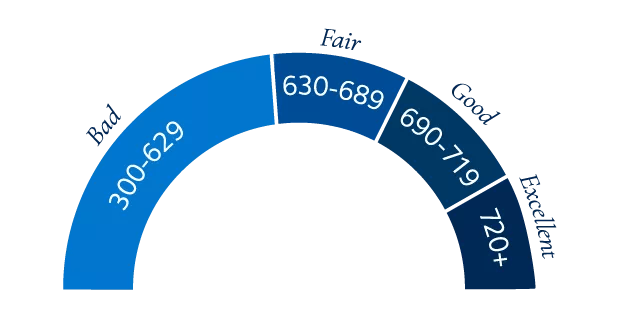

Credit scores can range from a low of 300 to a high of 850. Two companies—FICO and VantageScore—calculate credit scores and weigh credit score factors slightly differently. (That’s why you might see variation if you pull a credit report from different sources or at different times.) Scores also change frequently. In general:

- 300–629: Bad

- 630–689: Fair

- 690–719: Good

- 720+: Excellent

Tip: If you have an old card with no balance, there’s generally no harm to your credit score in keeping it.

How can you check your credit score?

If you have a credit card, you may have access to a free credit score at any time; check your statement.

How do credit scores affect you and how can you improve your credit score?

Credit scores don’t just impact whether you’re able to get a mortgages and car loans. The lower your credit score, the more you’ll pay for those loans: Your credit score directly impacts the interest rate a lending institution offers.

But a credit score isn’t a fixed number. Although it takes time, you can improve your credit score by focusing on the factors that affect it. For example, you can:

- Pay your bills on time. Set up automatic payments and pay everything within 30 days.

- Lower your credit utilization. Aim to use less than 30% of your available revolving credit (credit cards, for example).

- Increase the age of credit but decrease lingering balances. While paying off debt as soon as you’re able is key, it’s OK to have a credit card (with a zero or always-paid-off balance) longer.

- Build a credit mix. Consider some revolving debt (debt you pay off as you accumulate it—a credit card) and some installment debt (debt that’s paid in the same amount, on the same date, until the loan is paid off—a car loan, for example).

- Limit credit requests. Avoid lots of new applications, particularly if you’re close to applying for a big loan.

What is a credit report?

A credit report is a moment-in-time snapshot of your credit history and outlook. It’s used by a credit bureau to create a credit score, which as noted above impacts your ability to secure new credit or qualify for lower interest rates and may equal a lower cost of borrowing over time. Potential landlords may also pull a credit report before agreeing to rent to you, too.

A credit report includes personal information (name, birthdate, address) and a summary of credit accounts (types, date opened, limits/total loan, balance, payment history). It will also distinguish between credit inquiries. Soft inquiries, such as when you check your credit report, have no impact on your credit score. Hard inquiries, however, such as applying for credit or loans, may have a temporary negative impact on your credit score.

How to get a copy of your credit report

Good news: You can get a copy of your credit report once every 12 months—for free. Simply visit annualcreditreport.com to request a copy. When you receive it, check all the information to ensure it’s accurate. You can also request a credit report each year from Equifax, TransUnion, and Experian; each of those companies are required to provide you with an annual copy at no charge.

If you find mistakes on your credit report, you have a couple of options. Start with the credit bureau: File a written dispute (search to see if they offer a form to use). You’ll have to send it and any documentation you have by mail; certified is best. Follow the same procedure with the lending company or business reporting the error. Finally, use resources at identitytheft.gov to report ID theft.

Credit, credit score, and credit report reminders

- Practice good credit habits, such as paying all your bills on time.

- Pull your credit report for free once a year; add a reminder to your calendar. Report any errors immediately.

What's next?

Log in to your Principal account to assess your retirement savings rate so you can see how much progress you’re making toward your goals. Don’t have an employer-sponsored retirement account or want to save even more in addition to a 401(k)? We can help you set up your own IRA or Roth IRA. Ready to continue building your financial foundation? Our learning library has information on everything from building a budget to buying a home.