Risk accompanies all sorts of activities, including investment. What types of risks may impact your retirement and savings accounts?

Takeaways

- Many of your daily activities come with a share of risk. Investing does too. Learning about investment risk and your own risk tolerance can help you navigate your financial decisions.

- There are different types of investment risk, and each has its own impact on your investments. Your risk tolerance takes into account your experiences and your goals to help you find the risk level you’re comfortable with.

- Investment risk and risk tolerance must be balanced effectively so that you can take advantage of long-term opportunities and understand how to navigate market fluctuations.

Risk is inescapable. Take driving a car: It poses risk, but millions of adults get behind the wheel every day. But risk is also relative. Your neighbor may be a scuba diver, but going underwater with oxygen tanks may be completely off limits for you.

The same is true of investing risk: It is inescapable, and it is relative. How can you better understand both investment risk and risk tolerance, and figure out what you need to know to navigate them in pursuit of your financial goals? We’ve got insights.

What is investment risk?

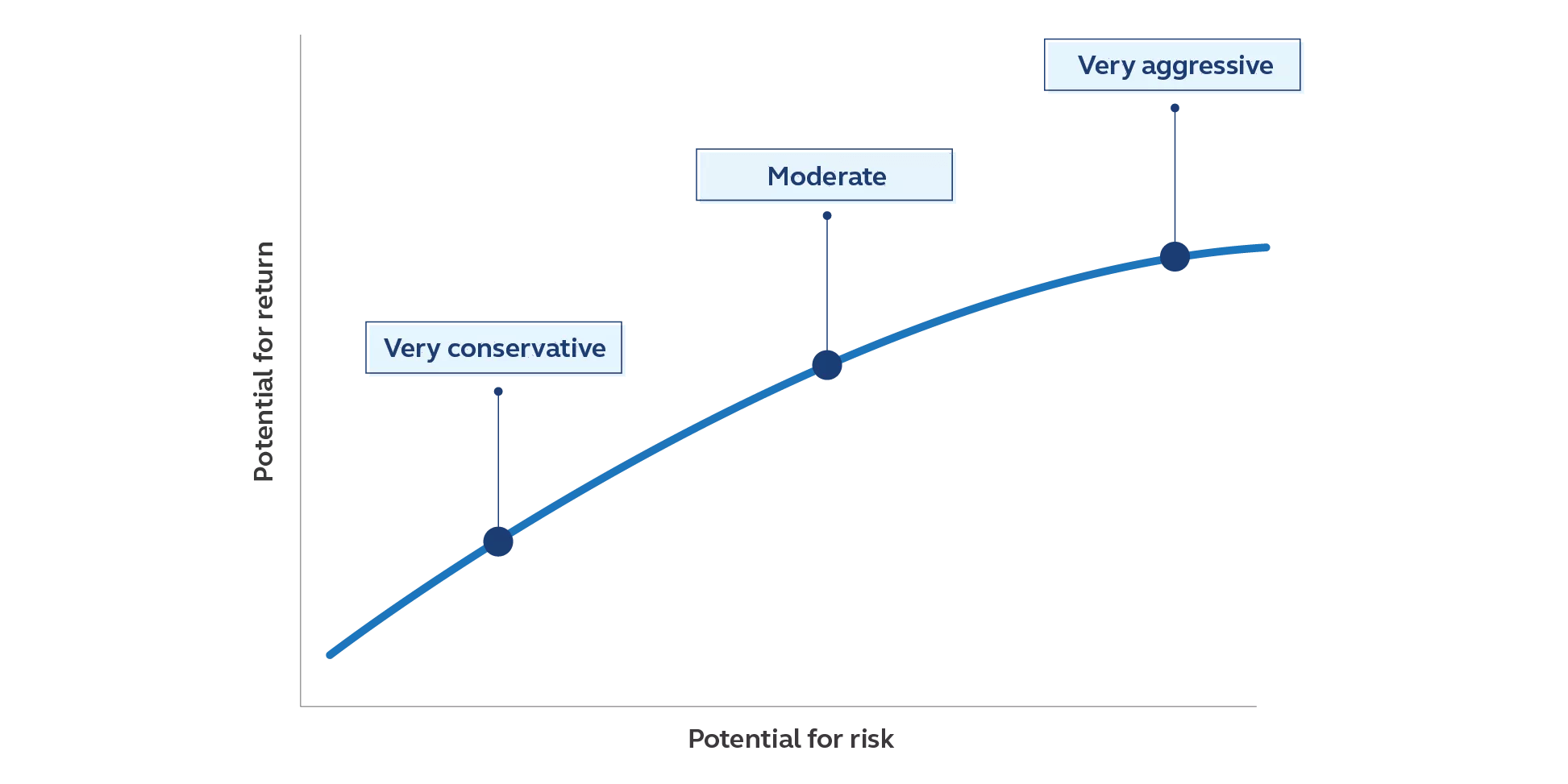

Investment risk refers to the degree of uncertainty inherent in an investment decision. In other words, when you invest in something—stocks or a home, for example—there’s no guarantee that you’ll make a return at all, much less the return you’re hoping for. In fact, you may have unexpected losses. On the flip side, a risky investment may pay off with unexpected returns. Typically, as risk goes up, the potential for greater rewards or losses does too.

Potential risk typically increases in parallel with potential reward.

What are the types of investment risk?

Investment risk doesn’t come from a single source: The stock market, economy, length of investment time, and more are all potential risks.

Types of investment risk

| The risk | What it is | Effect on investments |

|---|---|---|

| Inflation risk | The tendency for prices to increase over time | Future dollars (your investments) will not have as much buying power. |

| Interest rate risk | The risk to savings and loan rates if interest rates change | For money you want to grow (investments), interest rate increases are generally positive. For money you’re borrowing, increases are negative. |

| Market risk | The risk of loss due to financial market performance (differs from market volatility which is just how frequently and significantly an investment changes price over time) | Stocks vary from day-to-day and year-to-year. |

| Longevity risk | The risk of outliving your savings | The length of retirement is undetermined, making it tough to know how much money you’ll need. |

| Credit risk (corporate bonds) | The risk of default by the issuer of the bond | Bondholders may not be paid the promised interest or the full principal. |

And risk isn’t necessarily bad. Take inflation: It causes prices to increase over time. If you want your investments to keep pace with the risk of those increases, you may need to take on some risk.

What is risk tolerance?

Risk tolerance is actually a little more complicated than just how much risk you feel comfortable with. It’s a mix of what’s happened to you in the past, what’s going on now with your financial status, and your goals for the future. “Generally, there are three concepts associated with risk,” says Heather Winston, financial professional and product director for Retirement and Income Solutions at Principal®.

| Risk concept | What it means | What it could look like in real life |

|---|---|---|

| Risk capacity | How much risk you can afford to take. It's dictated by things like your investment timeline, income needs, and money available. | As you move closer to retirement, you change your investment mix to have more bonds and fewer stocks, trading the possibility of greater rewards (or loss) for more stable rates of return. |

| Risk tolerance | What's acceptable to you to gain or lose over time. | When you’re younger, you choose an investment mix that may be weighted heavily with stocks, knowing that you have time to recoup ups and downs from the market. |

| Risk composure | How you handle what’s happening in the market and the impact to your portfolio—for example, does an event trigger a specific emotional reaction? | You stay true to your savings strategy and don’t react to market fluctuations. |

How do you manage your investment risk and risk tolerance?

It can be helpful to generalize your risk profile and use that as a starting point. A risk profile quiz can help you find the level of risk you’re comfortable with, as you try to strike a balance with the years you have left until retirement.

Tip: Not sure if your risk profile is conservative or aggressive—or somewhere in between? This risk profile quiz (PDF) can help you learn more about your reactions to moments of uncertainty.

Finally, when you think about investment risk, it’s helpful to weigh short-term wariness with long-term opportunity. Look at the stock market: The S&P 500 has some years that are better than average, and some worse. Over the long haul, however, there have been fewer negative periods than positive. For the investors who took the risk and kept their money in, even when the markets were wobbly, the value of their investments likely increased.

And before you make any big changes, step back. “Fear of missing out can be strong, and we tend to be impatient,” Winston says. “Take a deep breath, slow down, and ask yourself, Do I want to do this? Why? What happens if this doesn't come to fruition the way I intended?”

Check-ins on investment risk and your risk tolerance

- Financial basics—a budget, an emergency fund—may help shield you from some market risks.

- Your risk tolerance may change. If you have a longer time frame, you may have more tolerance for risk, because you can make up losses. In general, your risk profile may get more conservative over time.

- Market moments of uncertainty shouldn’t pre-empt your saving and investment plan. The adage “it’s not timing the market, it’s time in the market” remains true.

What’s next?

How are you progressing toward your retirement goals? Log in to principal.com to see how you’re doing. Want to save outside of a workplace 401(k)? We can help you set up your own retirement savings with an IRA or Roth IRA account.