May not be available in all states or with all broker dealers.

Principal® Strategic Outcomes and Principal® Strategic Income do not directly participate in any stock, equity investments, or index. It is not possible to invest directly in an index.

Investing involves risk, including the possible loss of principal.

Before investing in registered index-linked annuities, investors should carefully consider the investment objectives, risks, charges and expenses of the contract and underlying investment options. This and other information is contained in the free prospectus which can be obtained from your local representative or online at principal.com. Please read the prospectus and, if available, the summary prospectus carefully before investing.

IMPORTANT CONSIDERATIONS

Index-linked deferred annuity contracts are complex insurance and investment vehicles. This contract is a security and there is a risk of substantial loss of principal and earnings. The risk of loss may be greater when early withdrawals are taken due to any charges and adjustments applied to such withdrawals. These charges and adjustments may result in loss even when the value of a segment option has increased. Clients should consult with a financial professional about the appropriateness of this product based on their financial situation and objectives.

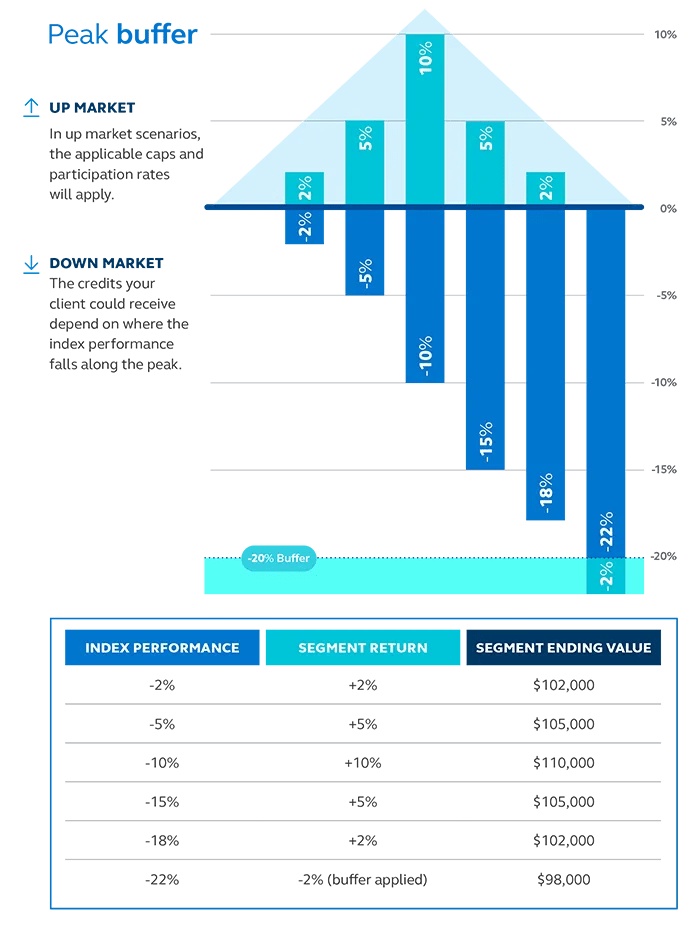

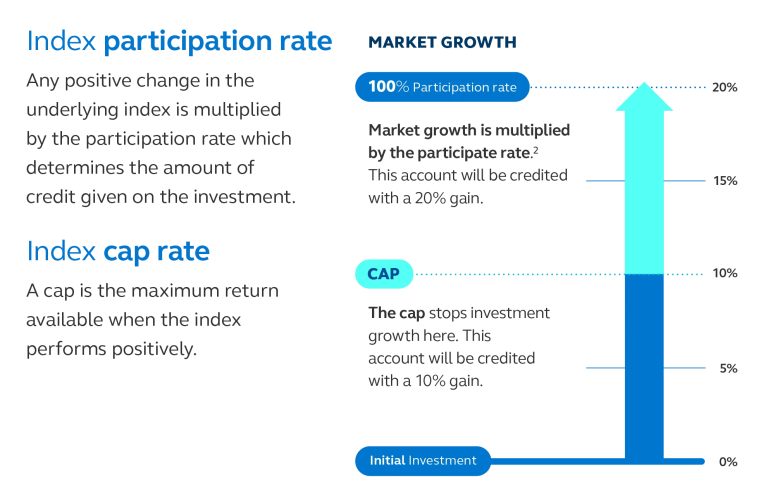

There is risk that this segment interim value could be less than the original premium payment even if the applicable Index has been performing positively. The buffer or floor rate provides limited protection. There is a possibility of a significant amount of loss of the total premium payment, credited interest and prior earnings. In the index-linked segment options it is possible that the total loss could be 100%. If clients choose to allocate amounts to an index-linked segment option subject to a cap rate, that rate limits the positive index change, if any, that may be credited to the annuity for a given segment term. The participation rate limits the positive index change, if any, that may be credited to the annuity for a given segment term. It is possible to receive less than the full protection of the buffer rate or floor rate. Once a segment lock-in is executed, it is irrevocable for that segment term. A lock-in will not be applied retroactively and can only be exercised for the entire segment option. A segment lock-in may only be exercised once per segment term for each index-linked segment option. There is no guarantee that any particular segment option or index will be available during the entire period.

Withdrawals will reduce the contract value and death benefit. Some withdrawals may be subject to additional charges and adjustments. Withdrawals before age 59 1/2 may be subject a 10% early withdrawal federal tax penalty in addition to ordinary income taxes.

Guarantees are based on the claims-paying ability of Principal Life Insurance Company®. All guarantees and benefits of the insurance policy are backed by the claims-paying ability of the issuing insurance company. Policy guarantees and benefits are not obligations of, nor backed by, the broker/dealer and/or insurance agency selling the policy, nor by any of their affiliates, and none of them makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.

Contract rider descriptions are not intended to cover all restrictions, conditions, or limitations. Refer to rider for full details. Riders subject to state availability and may be subject to an additional charge.

Annuity products and services are offered through Principal Life Insurance Company®. Securities offered through Principal Securities, Inc., member SIPC, and/or independent broker/dealers. Referenced companies are members of the Principal Financial Group®, Des Moines, Iowa 50392, principal.com.

Annuities have limitations. They are long-term vehicles designed for retirement purposes. Annuities are not intended to fund short-term savings goals.

S&P 500 is a trademark of S&P Global and is used under license. The product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the product.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

© 2025 Principal Financial Services, Inc.

Principal® Strategic Outcomes:

Contract: SF 1027

Riders/Endorsements: SF 1028, SF 1029, SF 1030, SF1031, SF 1032

Principal® Strategic Income:

SF 1027, SF 1028, SF 1029, SF 1031, SF 1032, SF 1053, SF 1054, SF 1055, ICC13 SF 932 / SF 932

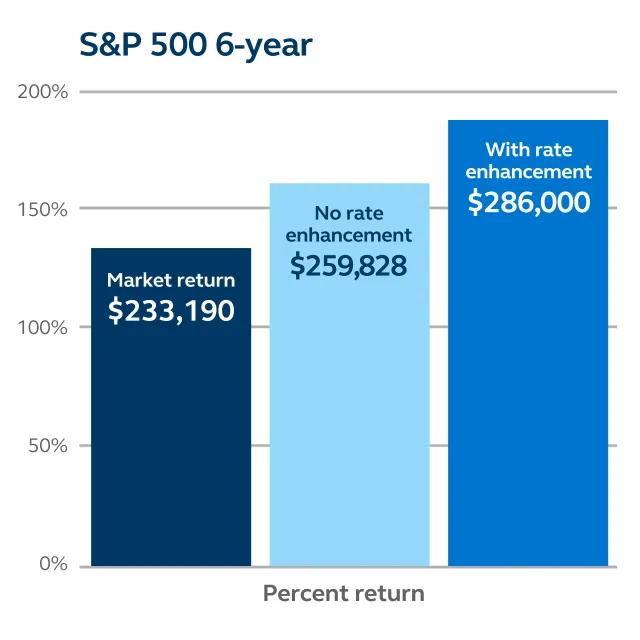

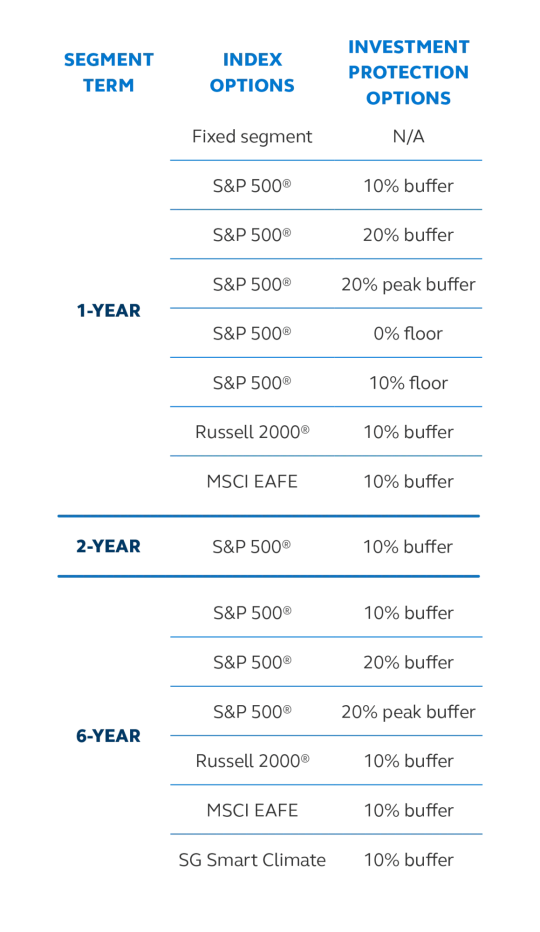

The S&P 500® index is comprised of equity securities issued by large-capitalization (“large-cap”) U.S. companies. Generally, it is more difficult for large-cap companies to pivot their strategies quickly in response to changes in their industry. In addition, because they typically are more well-established, it is rare to see large-cap companies have the high growth rates that can be seen with small-capitalization (“small-cap”) companies.

The RUSSELL 2000® index is comprised of equity securities of small-cap U.S. companies. Generally, the securities of small-cap companies are more volatile and riskier than the securities of large-cap companies.

The MSCI EAFE index is an equity index that is designed to represent the performance of large-and mid-cap securities across 21 developed markets around the world, excluding the U.S. and Canada. Unique to this index (as compared to the other available indices) are risks relating to political, social, and economic development abroad, as well as risks resulting from differences between the regulations and reporting standards and practices to which U.S. and foreign issuers are subject. To the extent foreign securities are denominated in foreign currencies, their values may be adversely affected by changes in currency exchange rates. All of the risks of investing in foreign securities are typically increased by investing in emerging market countries. Shifts in these factors can result in this index being more volatile than other indices.

The SG Smart Climate Index is the exclusive property of SG Americas Securities, LLC (together with its affiliates, “SG”). SG has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P”) to maintain and calculate the SG Smart Climate Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, “SG Smart Climate Index”, and “SG Climate Transition Risk Index” (collectively, the “SG Marks”) are trademarks or service marks of SG or have been licensed for use by SG from Entelligent, Inc. (“Entelligent”). SG has licensed use of the SG Marks to Principal Life Insurance Company (“Principal Life”) and sub-licensed the use of certain Entelligent marks (the “Entelligent Marks”) for use in a registered indexed annuity offered by Principal Life (the “Product”). SG’s sole contractual relationship with Principal Life is to license the SG Smart Climate Index and the SG Marks and sub-license the Entelligent Marks to Principal Life. None of SG, S&P, Entelligent or other third party licensor to SG (each individually, an “Index Party” and collectively, the “Index Parties”) is acting, or has been authorized to act, as an agent of Principal Life or has in any way sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Product or provided investment advice to Principal Life. The Index Parties have no obligation to make payments under the Product. The Index Parties make no representation or warranty, express or implied, to investors in the Product and hereby disclaim all warranties (including, without limitation, those of merchantability or fitness for a particular purpose or use): (a) regarding the advisability of investing in any products linked to the SG Smart Climate Index or (b) the suitability or appropriateness of an exposure to the SG Smart Climate Index in seeking to achieve any particular objective, including meeting its stated target volatility. No Index Party shall have any responsibility or liability for any losses in connection with the Product, including with respect to design, issuance, administration, actions of Principal Life, marketing, trading or performance of the Product. The Index Parties have not prepared any part of this document and no statements made herein can be attributed to the Index Parties. SG does not act as an investment adviser or provide investment advice in respect of the SG Smart Climate Index or the Product and does not accept any fiduciary or other duties in relation to the SG Smart Climate Index, the Licensee, the Product or any investors in the Product. The Index Parties shall have no liability for any act or failure to act in connection with the determination, adjustment or maintenance of the SG Smart Climate Index. Without limiting the foregoing, the Index Parties shall have no liability for any damages or lost profits, even if notified of the possibility of such damages. In calculating the daily performance of the SG Smart Climate Index, SG deducts 1.5% of the performance of the SG Smart Climate Index, which corresponds to the synthetic dividend yearly yield embedded in the SG Smart Climate Index. In addition, in calculating the daily performance of the sub-index comprising the SG Smart Climate Index, SG deducts fixed replication costs that cover, among other things, replicating the SG Smart Climate Index. The embedded costs will reduce the performance of the SG Smart Climate Index.

This index is an “excess return” index. The Index’s return reflects the total return on an investment in the underlying component stocks (including reinvestment of all dividends, interest, and other income), less certain negative adjustments and deductions that reduce the performance of the index. Contract rider descriptions are not intended to cover all restrictions, conditions or limitations. Refer to rider for full details.

ESG Methodology Risk. The Underlying SGI Index is composed of stocks that are selected based on an ESG methodology that includes climate risk scores and ESG exclusion filters. Investors’ views about ESG matters may differ from the Underlying SGI Index’s ESG methodology. As such, the ESG methodology may not reflect the beliefs or values of any particular investor. There is no guarantee that the ESG methodology will ultimately enhance the performance of the Index. The ESG methodology could detract from the performance of the Index, as companies with lower ESG ratings may perform better than companies with higher ESG ratings over the short or long term. Due to the inherent difficulty of forecasting within complex systems and the general unpredictability of future events, there is no guarantee that the predictive climate risk models used by the Underlying SGI Index will identify stocks that will perform well if climate events occur. Amounts invested in a Segment Option that is linked to the Index are not invested in the Index, the Underlying SGI Index, or the underlying stocks. Amounts that clients invest become assets of the Company. The assets in the Company’s General Account and the Separate Account, which the Company invests to support its payment obligations under the Contract, are not invested based on ESG factors. New Index Risk. The Index and the Underlying SGI Index have limited performance histories. Generally, there is less publicly available information about the Index and the Underlying SGI Index compared to more established market indexes. Inquiries regarding the Index or the Underlying SGI Index should be directed to our Administrative Office or a financial intermediary.