Everyone’s retirement dream is different, but the fear of outliving retirement savings is common.

Everyone’s retirement dream is different, but the fears are often the same. One of the biggest being the fear of outliving your retirement savings.

That’s why it’s important to protect a portion of your savings. Creating a source of protected income – that’s guaranteed for as long as you live -- can help provide the financial security you’ll need in retirement.

In fact, 84% of self-described happy retirees expect, or are currently receiving, guaranteed income from an annuity.

The money you’re saving now will need to fund your retirement later. By putting a portion of that savings into an income-focused variable annuity, you can potentially grow your savings now through market-based investments while also creating future retirement income that’s guaranteed for your lifetime.

There are three sources of income in retirement that you are guaranteed for as long as you live.

- Social Security

- Employer pension

- Income-focused annuity

You may or may not have a pension provided by your employer. And Social Security will only replace about 30% of your pre-retirement income.

- Create guaranteed income for life -- you choose when to start taking it

- Tax-deferred growth

- Three guaranteed income options to choose from

- Bonus and step-up features guarantee income growth regardless of how your investments perform

- Compounding interest on your potential investment earnings

Some factors to consider about a variable annuity: There are potential surrender fees and penalties for early withdrawal, and fees are typically higher on variable annuities than on fixed annuities. Please discuss the pros and cons of a variable annuity with a financial professional to see if it's a right fit for your financial plans.

Principal Lifetime Income Solutions II (PLIS II) is a market-based investment that allows you to create a source of retirement income. Your money will grow tax-deferred and benefit from compounding growth potential. Money that grows in your account will have two associated values— your account value and your withdrawal benefit base. The withdrawal benefit base is guaranteed for life.

When you invest in PLIS II, you’ll choose one of our three guaranteed income riders. Your money will grow based on the performance of the investments you choose within the rider. The rider that’s best for you may depend on several factors:

- Your comfort level with investment risk.

- Fees associated with the rider.

- Whether or not a bonus is right for you.

- The amount of time before you intend to start retirement income payments.

Here are some things to consider when deciding which guaranteed income option is best for you:

Target Income Protector

- Retirement at least 10+

- Looking for a higher guaranteed income stream

- Want growth potential even when markets are down

- Willing to pay higher fees to help maximize future income guarantees

Flexible Income Protector

- Plan to retire within 5 years

- Looking for a lower cost solution and want to avoid fees

- Want market growth opportunities

Flexible Income Protector Plus

- Plan to retire within seven to ten years

- Interested in market growth opportunities

- Want to limit investment losses in volatile markets

- Looking for growth potential even in down markets

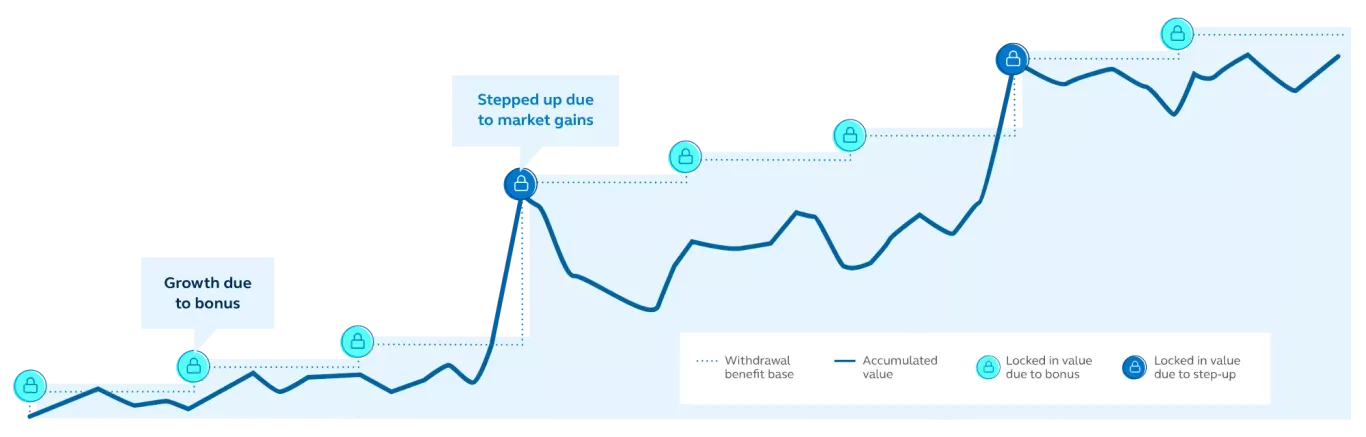

When you experience gains within your investment account, you are also building your withdrawal benefit base. It’s this base that will create your guaranteed future income.

Any investment gains are locked in via a “step-up”. The step-up is applied annually and ensures that gains are locked in to your base.

And we’ve created ways for your income to grow even if your investment doesn’t. Depending on which rider you choose, you could receive a bonus during years your investments don’t grow and a step-up isn’t available. The bonus keeps your future income growing even when your investments aren’t.

Like the step-up, bonuses are locked in. Income from this base is guaranteed for as long as you live.

You can begin taking income whenever you decide to retire. This is when you choose whether you want income for one or two people.

You’ll receive an amount based on how much money you’ve accumulated in your benefit base, your age when you begin taking income, and possibly how long you’ve been in the contract. These factors, along with the withdrawal percentage available when you purchased your contract, are used to determine the monthly income you’ll receive.

Here’s an example of how this works:

You have $300,000 in your benefit base

Your lifetime withdrawal percentage is 5.25%

This guarantees you a monthly income payment of $1,312.50

This could be a good investment if you:

Want to secure guaranteed income for your retirement.

Want to keep your money invested in the market for potential growth until you retire.

Want your money to keep growing tax-deferred.

Are willing to pay some fees based on the guarantees you receive in return.

Would like any of your unpaid benefits passed on to your beneficiaries.

Talk with your financial professional to learn more and decide if Principal Lifetime Income Solutions II is right for you.