Let’s dispel some of the common myths about Social Security and its funding status. Here we explore the program’s structure, demographic challenges, and possible outcomes if no legislative action is taken soon.

For decades, Social Security has served as a foundational element of retirement security in the United States. Nearly every American contributes to it throughout their working years, and many rely on it or are planning on it for a substantial part of their income in retirement.

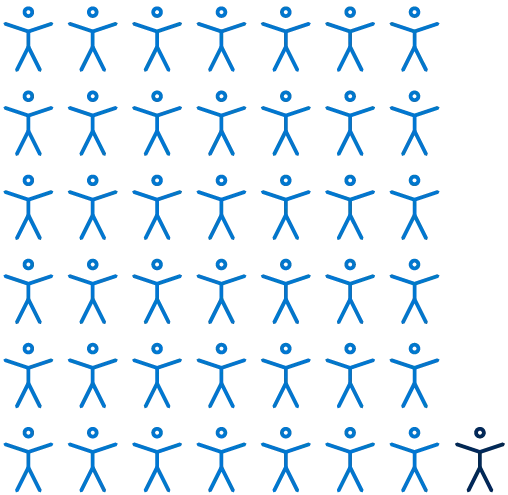

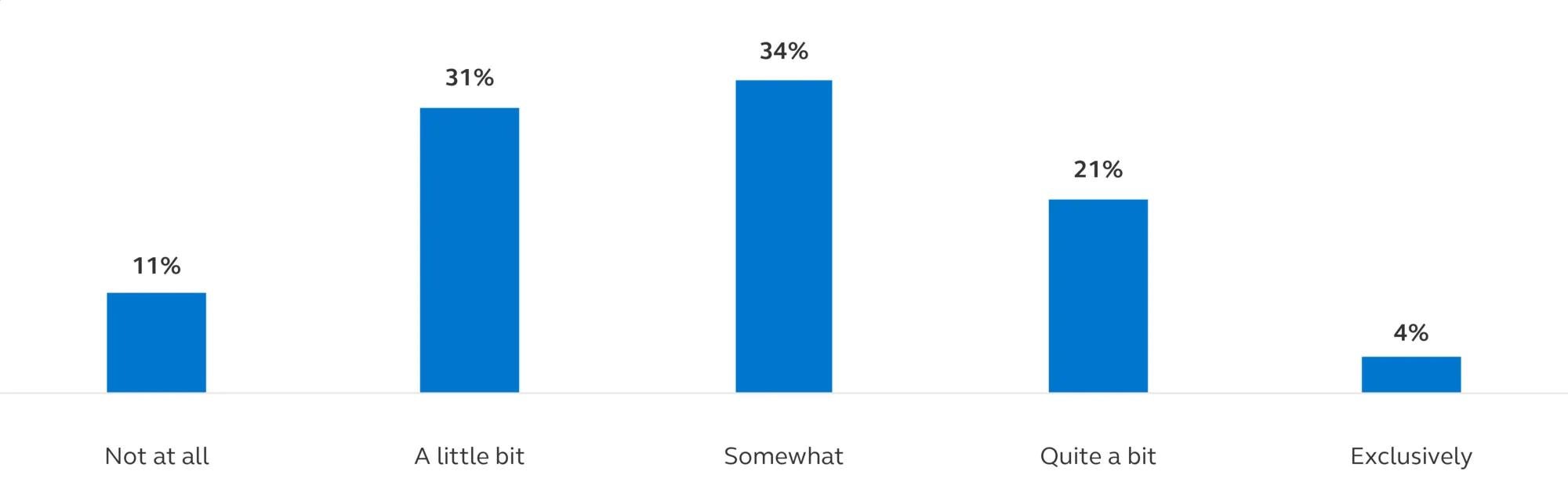

Q: How much do you expect to rely on Social Security money after you turn 67?

Principal® Retirement Real Life Retirement Journeys Survey, August 23-September 11, 2024.

Despite its critical role, Social Security is often misunderstood, leading to a variety of myths that cloud the public’s perception of its future and sustainability. Let’s take a closer look at how Social Security works, the funding challenges it faces, and bust some of the more common myths.

How Social Security Works

Social Security operates primarily as a pay-as-you-go system, funded by payroll taxes collected from current workers and their employers. Each worker pays 6.2% of their earnings (up to a wage cap—$168,600 for 2024) into the Social Security “Trust Fund” (there are actually two accounts comprising the Trust fund accounts; one dedicated to old age and survivor benefits and the other for disability benefits) and their employer matches that contribution. The taxes collected are used to pay benefits to current retirees, disabled individuals, and survivors of deceased workers.

The Funding Problem: Why is the Social Security trust fund running low?

The primary reason Social Security faces a funding shortfall is demographic. In 1945 there were 42 workers paying into the system per beneficiary receiving benefits.

In 1945 there were 42 workers paying into the system per beneficiary receiving benefits. By 2035 the ratio is expected to drop to 2.4 workers per beneficiary.

1945

2035

From the mid-1980’s through 2020, Social Security collected more in taxes than it paid out in benefits, creating an excess known as Social Security’s asset reserves. These funds were deposited into the Trust Fund and invested in interest-bearing Treasury securities. When established, the Trust Fund was meant to act as a buffer to help cover future shortfalls.

When asked if they think Social Security will still be available by the time they are 67 years old:

56%

either say, “No.” or “I’m not sure.”

Principal® Retirement Real Life Retirement Journeys Survey, August 23-September 11, 2024.

Since then, a shift has occurred in our population. A higher proportion of workers—the baby boomers—have moved into retirement, receiving Social Security benefits rather than paying into the system. Payroll taxes coming into the system no longer cover the cost of providing full benefits. The Trust Fund with the Social Security reserves now must be used to make up the shortfall. At the current rate of withdrawals from the Trust Fund, it’s expected to be exhausted by 2035.

Two common misconceptions about Social Security

In ten years, Social Security will be broke and disappear entirely.

Fact

Social Security is funded by payroll tax contributions by both workers and employers. Even if no legislative action is taken, these taxes will continue to fund the program. Though benefits may need to be reduced, Social Security would still exist.

The Social Security Trust Fund was raided by former Administrations and Congresses, causing the funding crisis.

Fact

This is a persistent myth, but it’s not accurate. Social Security is funded by payroll taxes, with any excess deposited into the Trust Fund and invested, by law, into special-issue U.S. Treasury bonds.

As with all Treasury bonds, the federal government may borrow from the Trust Fund in the same way it borrows from other investors who purchase U.S. Treasury bonds. Treasury is required to pay back the obligations with interest and has always done so. The Trust Fund has never been put into the general fund of the government and the claim that the government has stolen from Social Security is 100% fiction.

What Happens if Congress Doesn’t Act?

Any solution will not be politically easy, but without changes, Social Security faces a future of reduced benefits. If no legislative changes are made before the Trust Fund is depleted, Social Security will automatically reduce benefits by approximately 20% to align with incoming payroll tax revenue.

Furthermore, a cut in benefits could exacerbate poverty rates among the adults aged 65 and over. Social Security benefits lift more than 16.5 million of these older adults above the official poverty line.

What’s next?

Social Security remains a cornerstone of retirement security, but it faces real financial challenges that must be addressed. While the program is not on the verge of disappearing, without legislative action, beneficiaries will likely see reduced benefits in the future. By understanding the facts about how Social Security works and the nature of its funding problems, Americans can better advocate for the changes necessary to help protect it for generations to come.

Find more legislative updates and retirement trends on the Principal retirement research and insights webpage.